Quantum Hedging

Is Partnering with Elevators

We’re changing the game in commodity risk management.—specifically building predictive tools to help grain elevators, co-ops, and farmers make more confident marketing decisions.

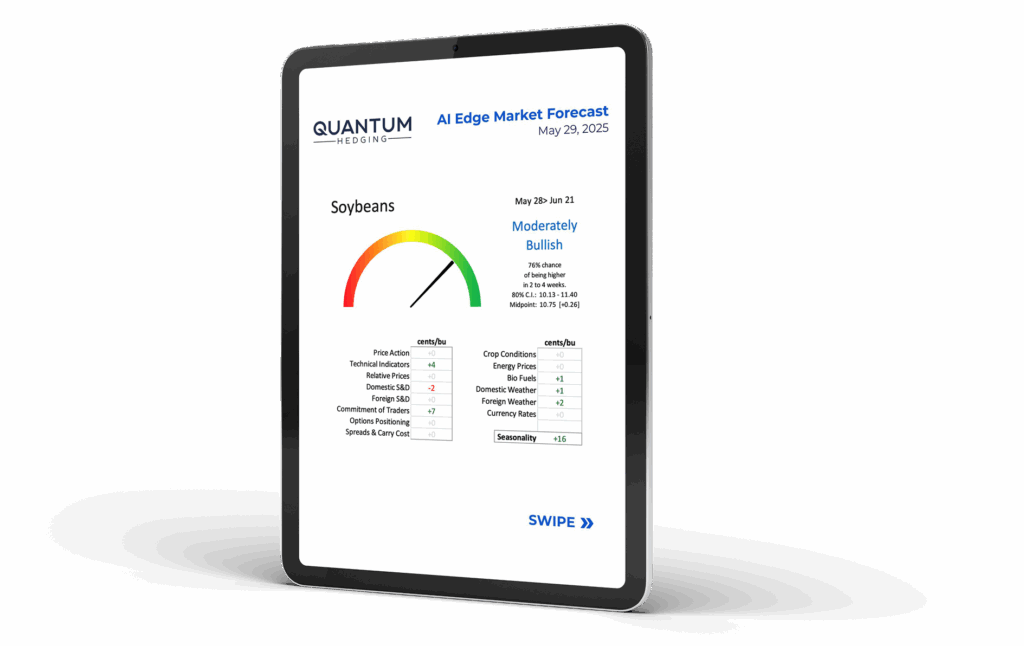

- Data Driven Research product: Weekly forecasts from our model delivered directly to you.

- Calendar Spread Predictions: Improves how you hedge, price, and manage grain flow throughout the year.

- Managed Bushels ProgramS: MAX10 and Enhanced Plus Programs

No Target-No Fee Guarantee.

For the past two years, our Managed Bushels programs have successfully reached their pricing targets.

Quantum Hedging Compass

Get FREE Market Analysis

from Quantum Hedging

Sign up the AI Edge Market Forecast for our weekly AI-driven insights and analysis on the corn and soybean markets, straight to your inbox.

Our AI Models*

Beat the Corn & Bean Cash Sale Index in 2024

+9.5¢*

Outperformance

+4.8¢*

Outperformance

*Back-tested results are hypothetical. AI forecasts are forward-looking estimates based on historical data. Actual results may differ materially; past trends are not indicative of future performance. See full disclosure at bottom.

Frequently Asked Questions

The Max10 program is a data-driven, machine-learning based grain marketing system powered by millions of data points and over 30 years of market history. Our goal is to sell your grain at a price within 10% of the market high during each program's pricing window.

Our models analyze more than a thousand data features including weather patterns, supply and demand shifts, technical indicators, global energy and currency movements, even human behavior trends. And they uncover the signals and patterns no simple spreadsheet — and certainly no human — can reliably detect.

Our models recommend futures and options strategies with a goal to provide you the best probability —with the least amount of risk. No unproven narratives. No hunches. Just relevant data, cutting-edge models, and a measured probabilistic edge.

This program gives you an unbiased, data-driven pricing option to offer your farmers. This program allows them to sell a percentage of their grain to you without the stress or the emotional rollercoaster of trying to “pick the high” or sell at the most opportune time. MAX10 offers 5 different pricing timeframes that span a 2 year period, so it is possible to have one producer sell bushels utilizing all 5 pricing timeframes. One of the biggest advantages to the elevator is this is a straightforward, easy to navigate contract and all the bushels are guaranteed to price. The MAX10 program does have flexibility built in though, whether it be delivery timeframe, delivery location, or the ability for an early out option. All fees are clearly defined and no fees are collected up front, which allows you to focus on buying bushels early, then manage your elevator’s logistics and margins accordingly. Another great feature is the MAX10 program is set up to personally reward the merchant/originator who hustles and originates bushels into the program. Quantum Hedging will handle establishing the MAX10 futures price. Once the contract is set up, all the merchant needs to do is assist the farmer in establishing the basis anytime after the contract establishment, but prior to delivery. Once the farmer delivers the grain to the designated elevator, your team can settle the tickets and make the payment to the farmer.

We won’t hit the high, but we are aiming to set futures on these bushels within 10% of the max price in the given pricing period. The high for the futures month selected might come during a time that isn’t in the selected pricing window, but we do offer multiple pricing windows of varying lengths for harvest delivery as well as a post-harvest/storage window.

If your question is not answered in this FAQ, please contact our support team at 312-429-7391.

Feedback and suggestions are welcome. Please email us with your comments at team@quantum-hedging.com