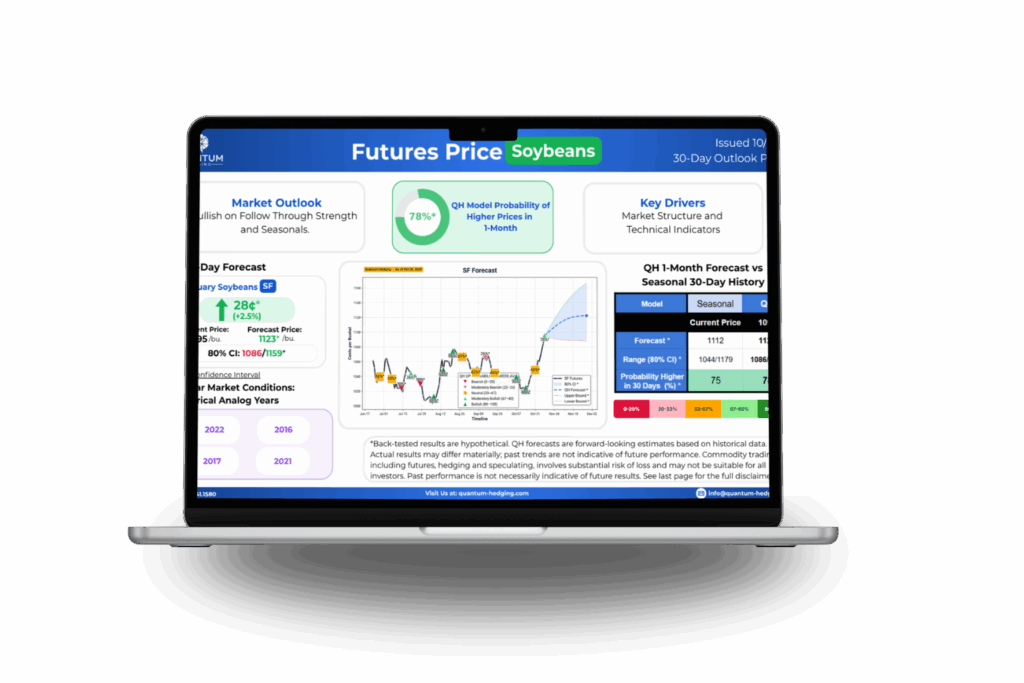

Trade Commodities with Data-Driven Precision

AI-powered insights for farmers, elevators and investors to make more confident trading decisions.

No Target-No Fee Guarantee

For the past two years, our Managed Bushels programs have successfully reached their pricing targets.

Quantum Hedging Compass

Corn Holds Slight Bullish Bias as Soybeans Turn Softer — Quantum Hedging Weekly Forecast (Nov 17) We’re...

Read More

No posts found

Harvest Yield Analytics (HYA) The model captures real-time yield results from commercial seed company trial results during the fall...

Read More

No posts found

Get FREE Market Analysis

from Quantum Hedging

Sign up to receive our Weekly Research Product and Data-Driven Insights on the corn and soybean markets, delivered straight to your inbox

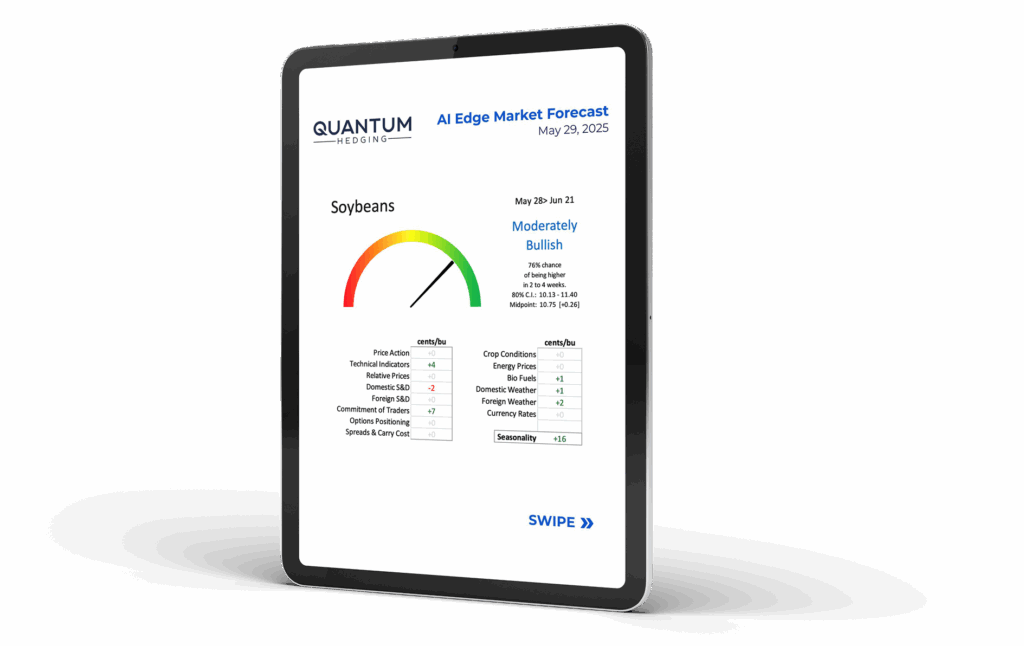

Get FREE Market Analysis

from Quantum Hedging

Sign up the AI Edge Market Forecast for our weekly AI-driven insights and analysis on the corn and soybean markets, straight to your inbox.

MODEL PREDICTED

MARKET DIRECTION

BULLISH & BEARISH

MARKET DRIVERS

PROBABILISTIC

EDGE