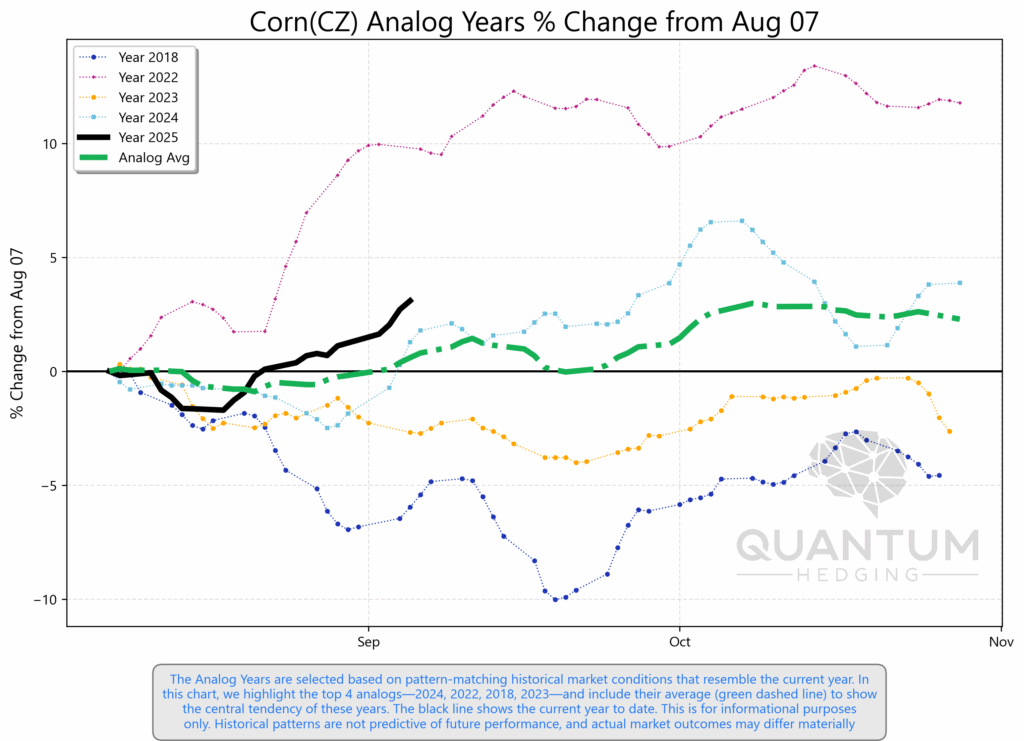

Corn: Support from Weather, Neutral Signals Into Harvest

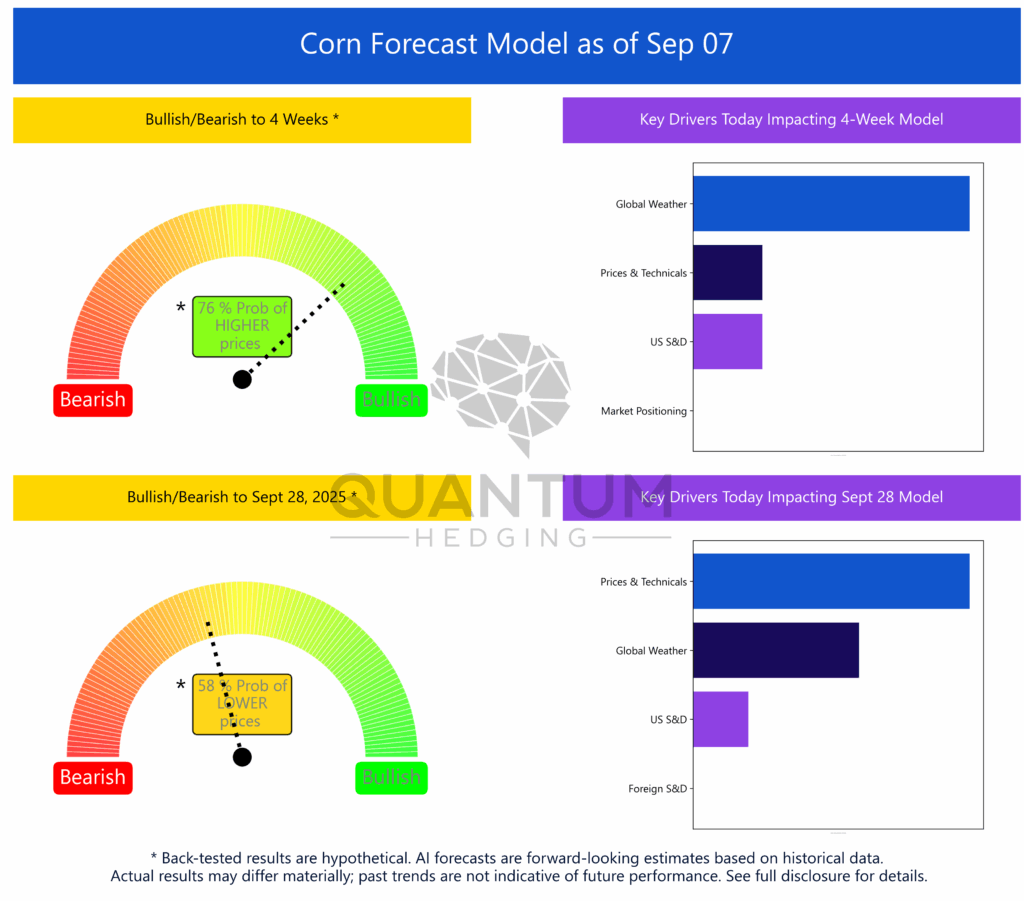

The Quantum Hedging corn model is showing a 76%* probability of higher prices over the next 4 weeks, with global weather emerging as the leading driver, followed by technicals and U.S. supply & demand. This tilts the model’s near-term outlook upward, though the strength lies more in external and seasonal dynamics than in a high-conviction market move.

By late September, the picture becomes more balanced. The model shifts toward neutrality, with a 58%* probability leaning slightly toward lower prices. Medium-term signals are driven mainly by prices & technicals alongside global weather, suggesting the market may lack a clear directional bias as harvest approaches.

Forecasts place corn in a range between $3.57* and $4.51* through October, with the central path hovering just above $4.00*. The key question is whether short-term weather support can translate into lasting strength, or if yield outcomes and harvest flow will bring the market back to a steadier, more neutral footing.

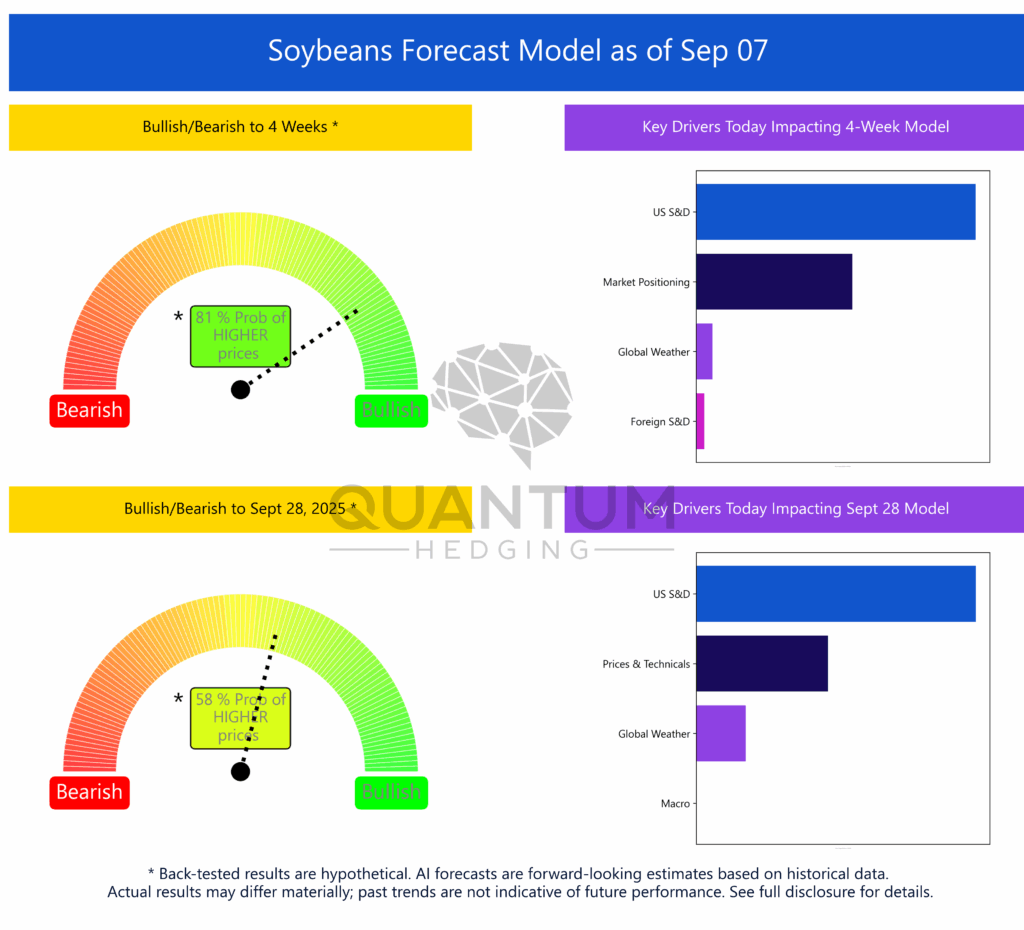

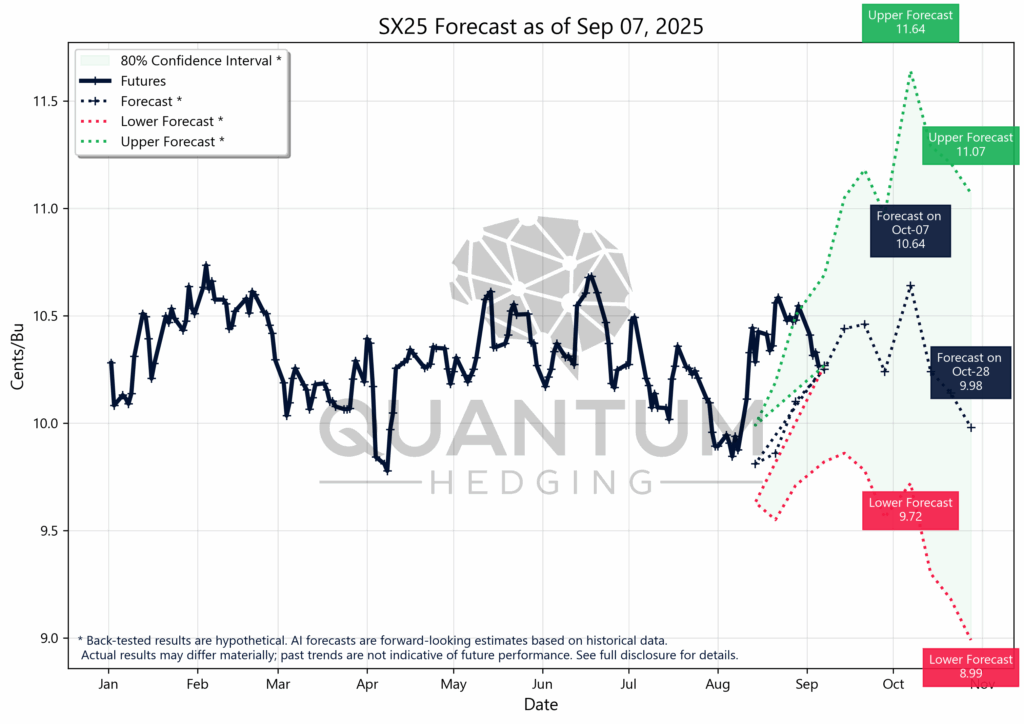

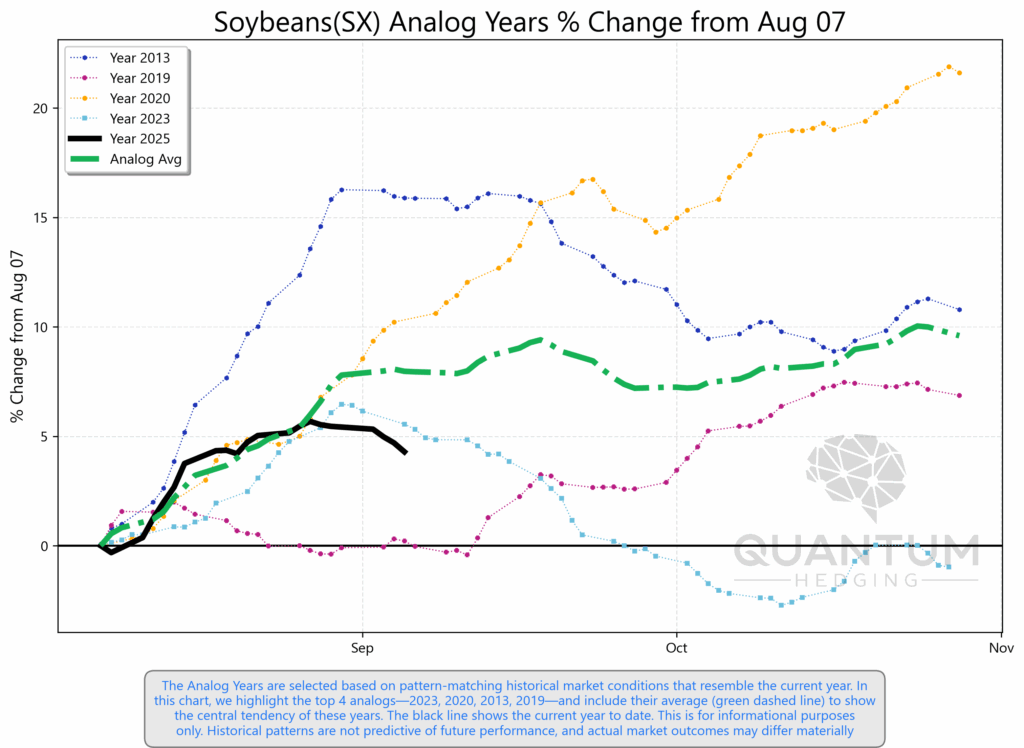

Soybeans: Upward Lean, But Conviction Softens

The Quantum Hedging soybean model is showing an 81%* probability of higher prices over the next 4 weeks, with U.S. supply & demand as the leading driver, supported by market positioning. This provides a constructive short-term tilt, though the outlook is not as forceful as prior weeks.

By late September, the model moderates to a 58%* probability of higher prices, signaling a more neutral stance. Key influences shift toward prices & technicals and U.S. supply & demand, with global weather still playing a secondary role. This balance points to a market that leans supportive but lacks decisive momentum.

The forecast path keeps soybeans trading between $8.99* and $11.64* through October, with the central path near $10.50*. Much depends on how U.S. demand evolves and whether export flows firm up into harvest. If those factors hold steady, the market may sustain its upward bias; if they weaken, soybeans could slip back toward a softer footing.

*Hypothetical performance; not actual results. Excludes commissions and exchange/regulatory fees.

*Back-tested results are hypothetical. AI forecasts are forward-looking estimates based on historical data. Actual results may differ materially; past trends are not indicative of future performance. See full disclosure for details.