Corn: Bulls Back on the Board—But Don’t Get Too Comfortable

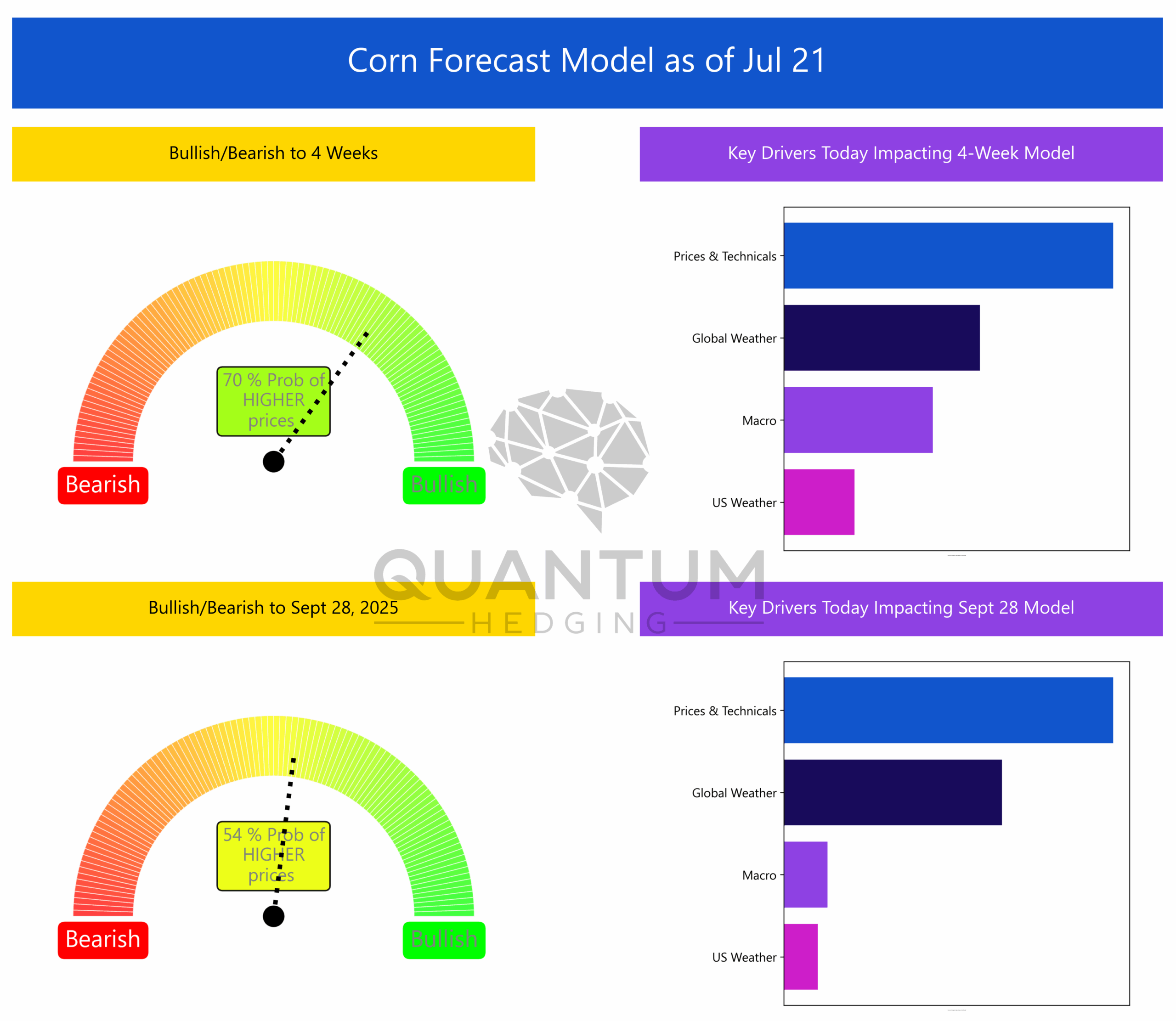

The Quantum Hedging corn model has staged a sharp reversal this week, flipping to 70% bullish for the next four weeks as of July 21. That’s a dramatic pivot from last week’s deeply bearish posture and marks the first time in a month the model has leaned this heavily to the upside.

What’s behind the shift? Primarily, it’s positive technical price action and improving macro conditions. Corn futures have shown some resilience lately, bouncing from recent lows and breaking out of oversold territory. At the same time, shifts in global economic indicators—including weaker currencies in competing exporter regions—are offering some supportive footing for U.S. grain markets.

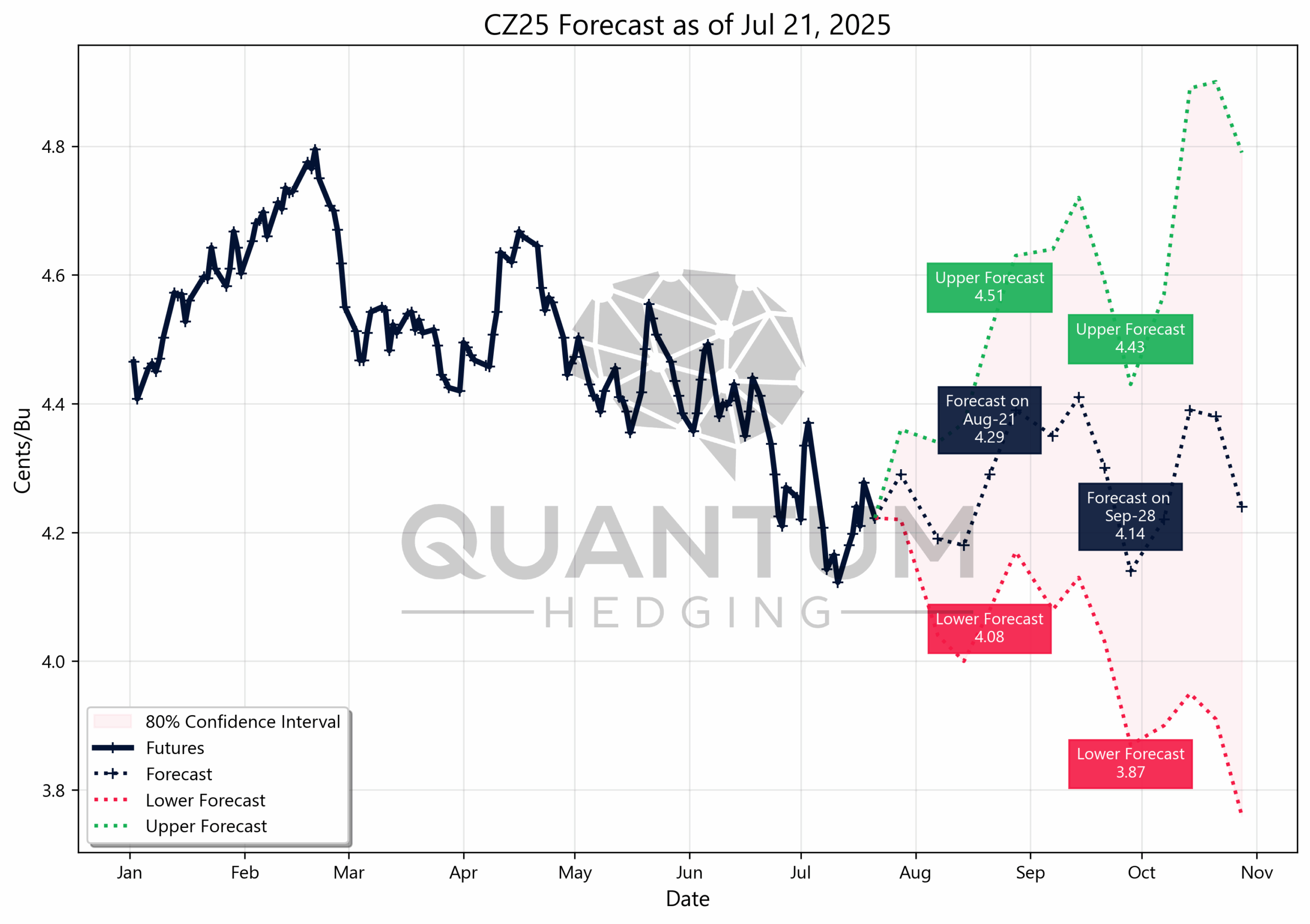

The near-term outlook is further supported by the CZ25 forecast, which now sees corn potentially climbing to $4.29 by August 21, with upside scenarios reaching as high as $4.51. Even the downside risk appears tempered, with the lower bound now sitting around $4.08, well off the mid-$3s threat of just two weeks ago.

However, this doesn’t mean the bearish case has evaporated. The model’s longer-term view through September 28 still shows only a 54% probability of higher prices—a near-neutral stance that suggests uncertainty remains high. The drivers here are more balanced, with Prices & Technicals and Global Weather contributing to modest upside, but U.S. weather and broader macro factors still acting as anchors.

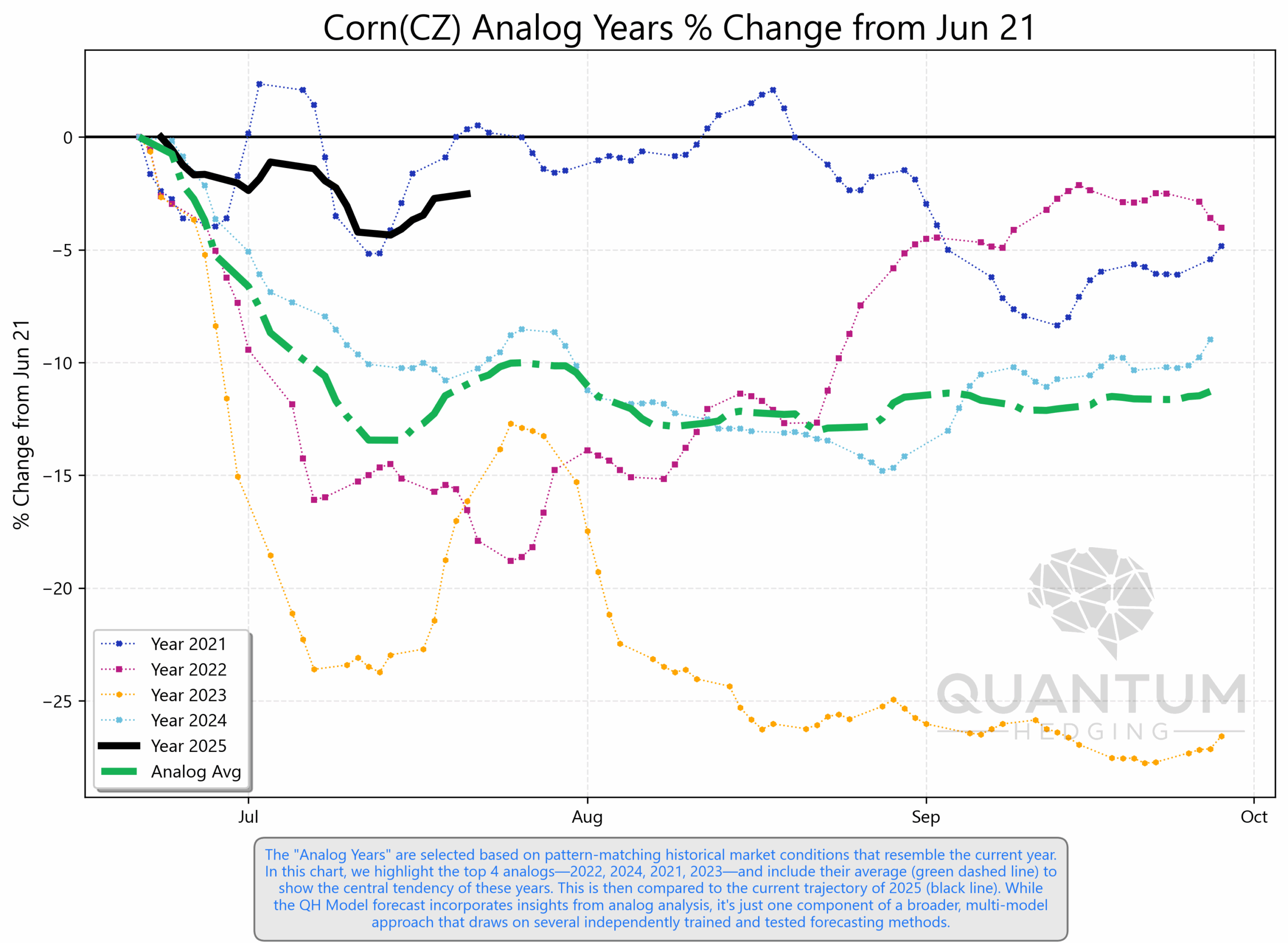

That caution is echoed in the analog year analysis, where 2025’s path (black line) is still trending closely with historically bearish years like 2022 and 2023. While the recent price rebound is evident, the longer-term analog track suggests any rally may be short-lived if fundamental pressure resumes.

Bottom line: this week’s model is flashing green, but the foundation for that optimism is still fragile. Bulls have momentum on their side—for now—but until crop stress shows up or demand accelerates, the upside could remain limited. The model isn’t betting on a runaway rally, just a reprieve from the selloff.

Soybeans: Bullish Momentum Builds, But Weather Still Looms

The Quantum Hedging soybean model has strengthened its bullish posture this week, flashing a 76% probability of higher prices over the next four weeks as of July 21. That’s the highest near-term confidence level in over a month—and it comes with strong backing from both technical and weather-related indicators.

Leading the charge is a surge in US weather influence, but not for the usual reasons. While conditions remain relatively stable, they’re no longer overwhelmingly bearish—opening the door for risk premiums to return, especially as the critical pod-fill stage approaches. Combine that with favorable price action and supportive global weather and S&D signals, and the model sees solid near-term upside potential.

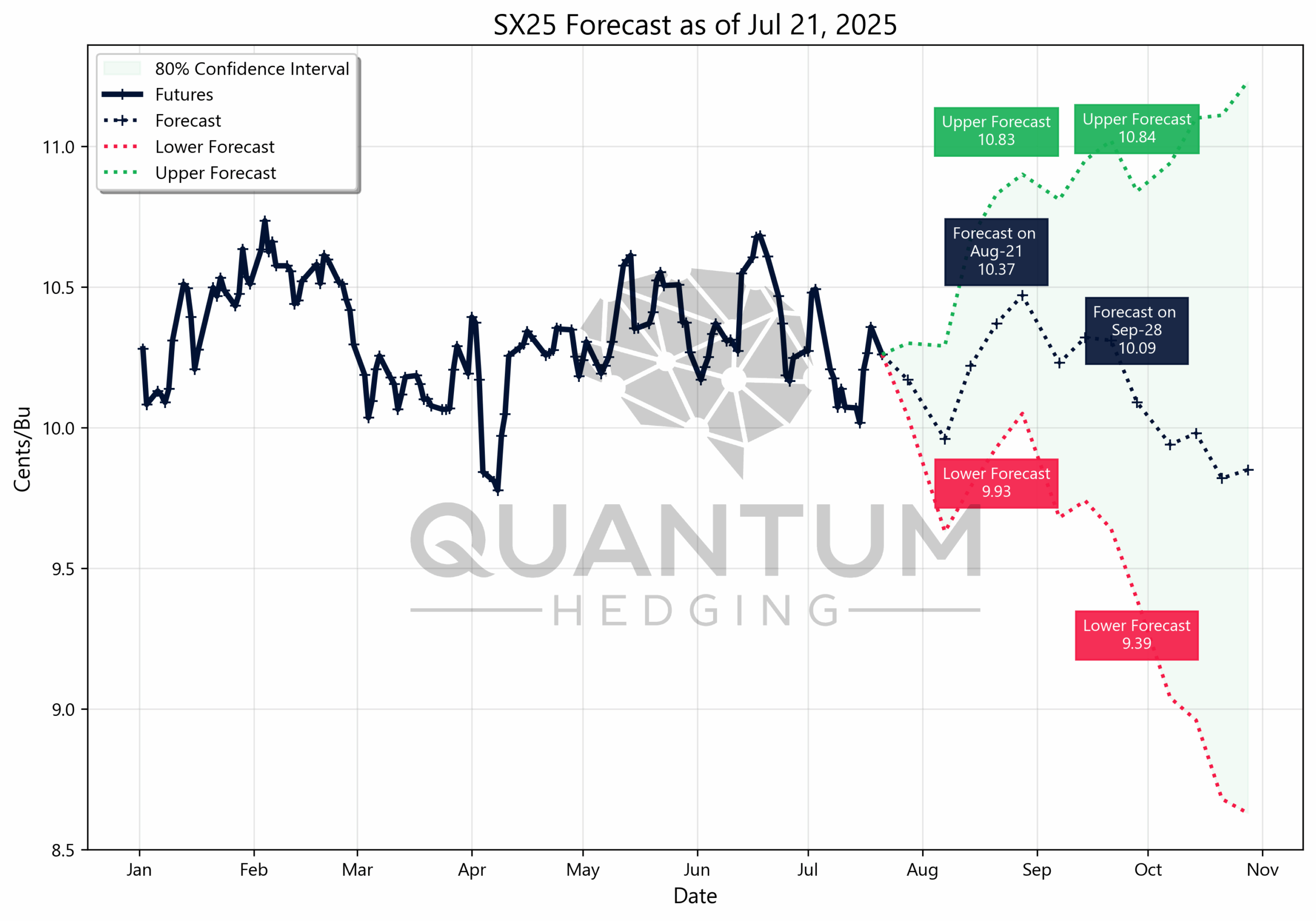

The SX25 forecast now targets $10.37 by August 21, with the upper bound at $10.83—levels not seen since early summer. Even the lower forecast floor has firmed up at $9.93, suggesting downside risk is less threatening than in recent weeks. Out through September 28, the model shows a 58% probability of higher prices, leaning bullish but with softer conviction than in the short-term window.

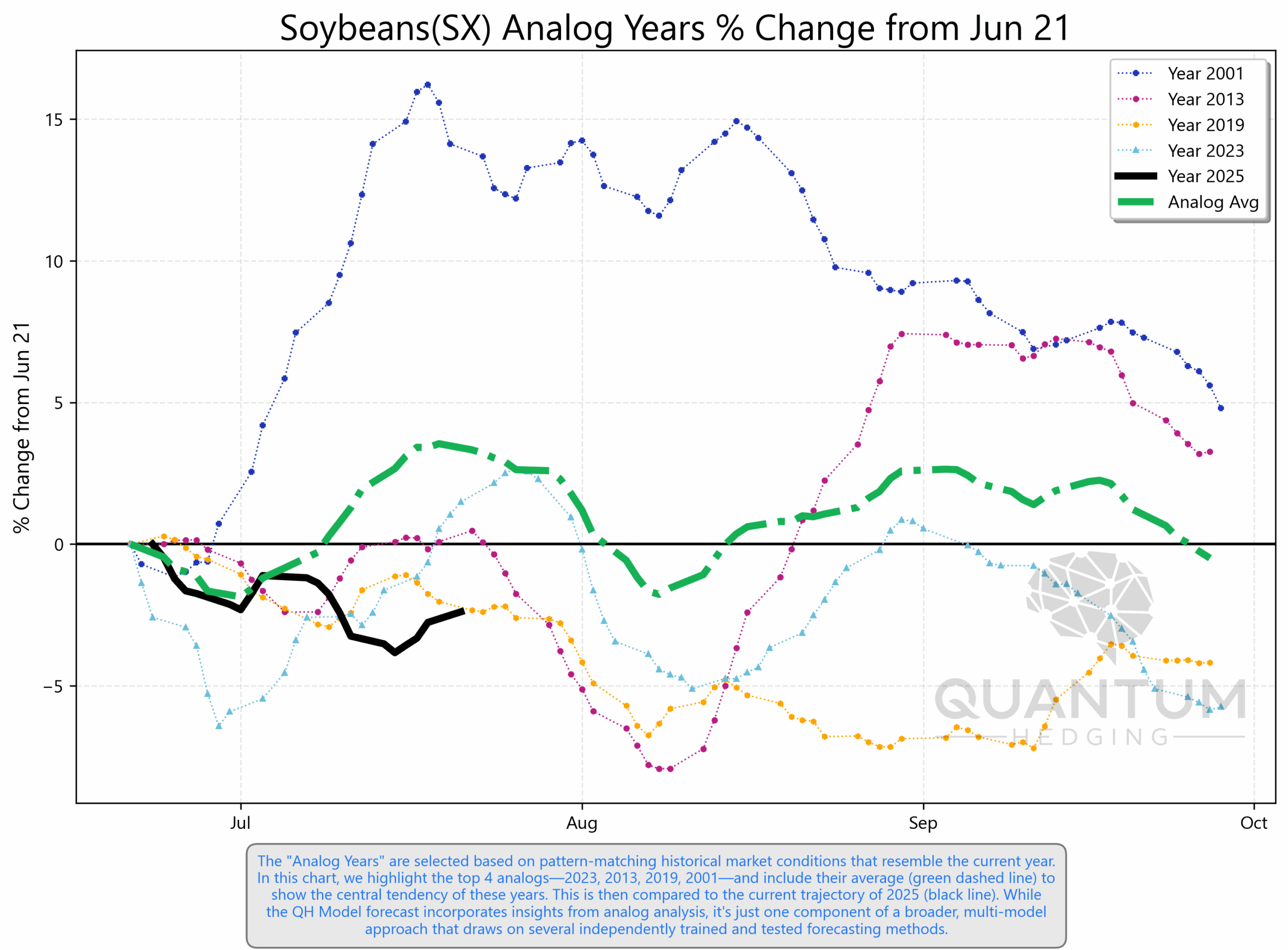

Supporting that tempered optimism, the analog year analysis places 2025’s trajectory (black line) just below the zero line—mildly negative—but still above many weaker analogs like 2013 and 2023. Historical paths suggest there’s room for a rally if demand or weather surprises tip the balance, particularly into August.

Bottom line: soybeans have reclaimed bullish momentum, powered by a favorable shift in weather sentiment and technical strength. But the rally remains fragile. With weather still a wildcard and long-term positioning uncertain, bulls should enjoy the bounce—but stay alert.