Corn: Collapse Mode Engaged

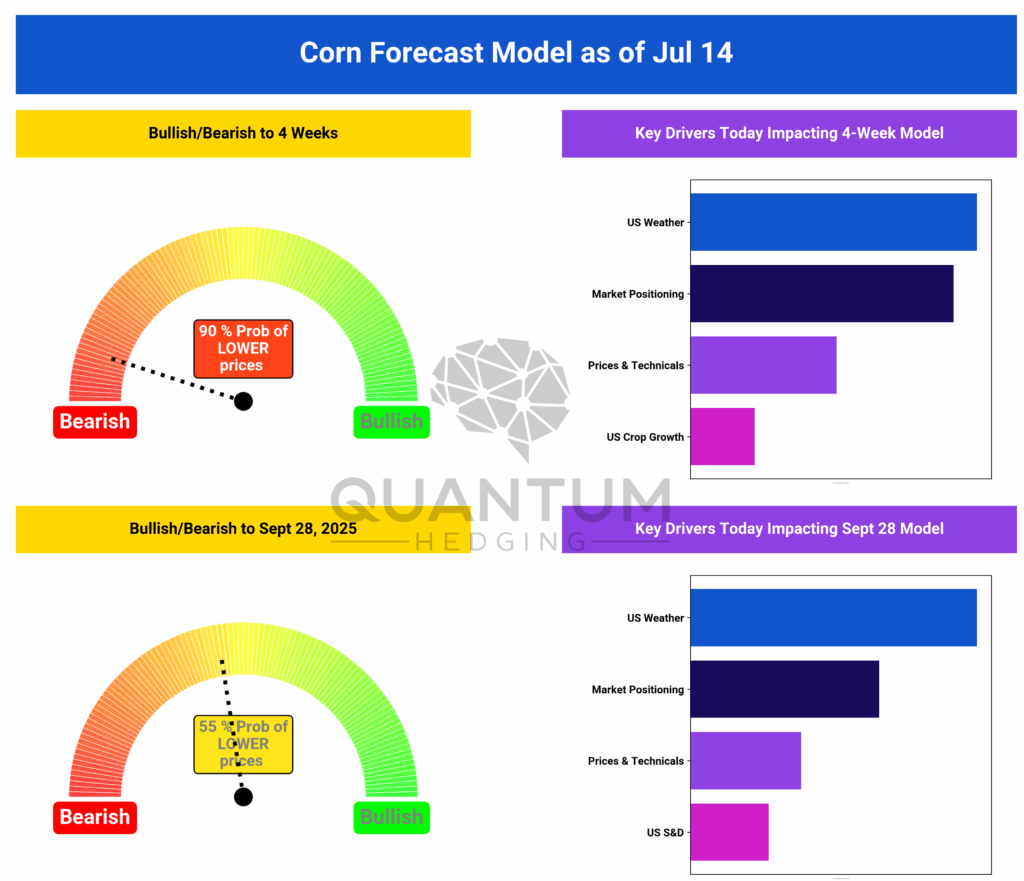

The Quantum Hedging corn model just turned the volume all the way up on its bearish call. As of July 14, it’s flashing a striking 90% probability of lower prices over the next four weeks—a sharp escalation from last week’s 61%. This is full-blown selloff territory..

The catalyst? It’s a perfect bearish storm: U.S. weather continues to be near-ideal for crop development, and market positioning suggests traders are leaning heavily into that narrative. Add in visible strength in crop conditions, and you’ve got a market primed for further downside. At this point, short-term bulls have almost nothing to hang onto.

The longer-term picture out to September 28 offers only marginally more balance, but not by much. The model now sees a 55% probability of lower prices, with bearish sentiment still in control. Weather remains the primary weight, but positioning and technicals are adding to the drag. Notably, even U.S. supply and demand dynamics are now contributing to the downward tilt, which is a shift from prior weeks.

Supporting this outlook, the updated CZ25 forecast projects a continued grind lower into August, with a base case at $3.84 by mid-August and a lower bound near $3.62. Even the upper end of the confidence interval only recovers to $4.08, well below the spring highs. By late September, prices are still forecast to be stuck in the low $4.20s, with the downside risk firmly intact.

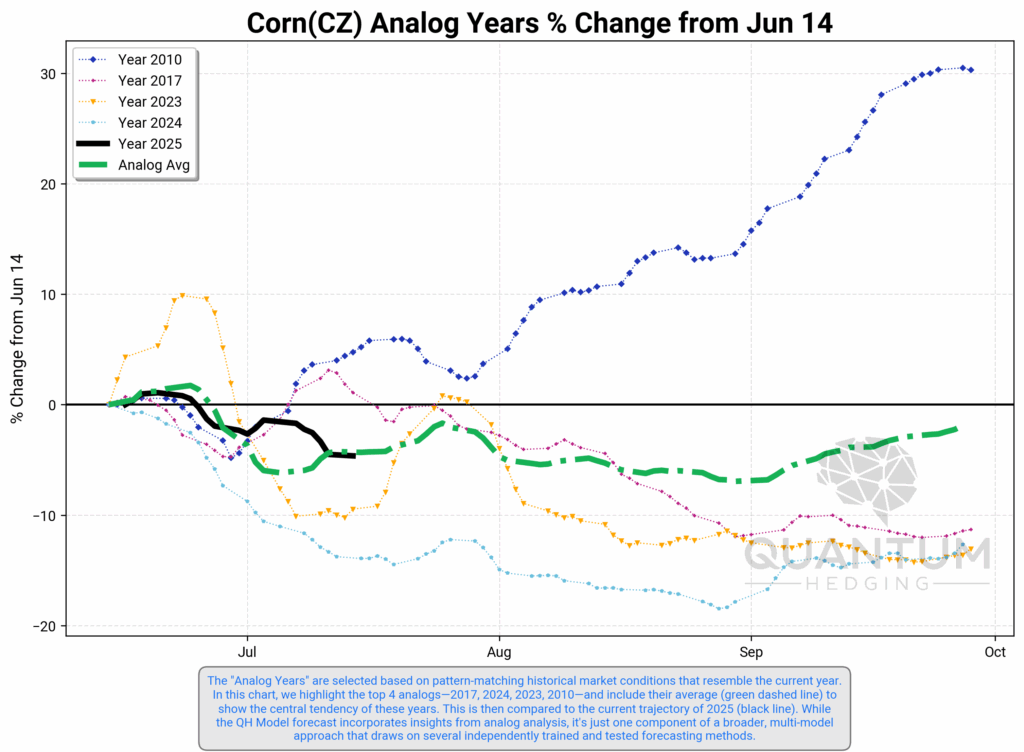

And if that wasn’t enough, the Analog Year chart is confirming the model’s skepticism. 2025 is tracking right in line with some of the most bearish historical years like 2023 and 2024. All trajectories from those years pointed lower from mid-June through harvest, and the current path is following that script nearly to the letter.

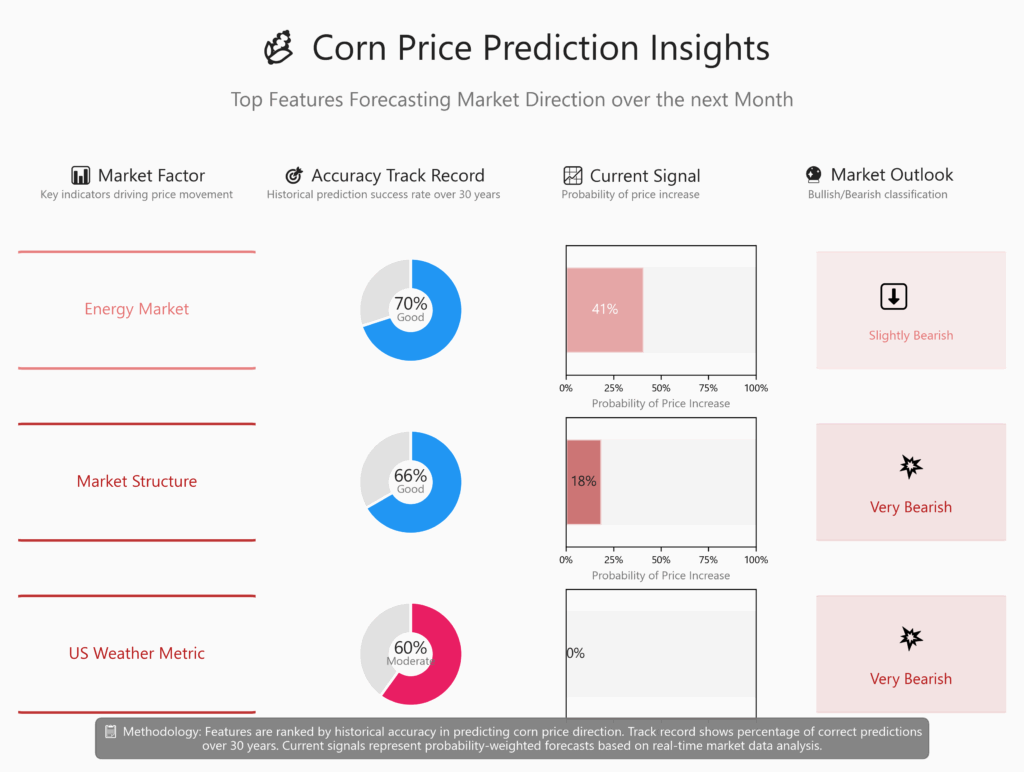

This message is further reinforced by the latest feature analysis chart, which shows that all three of the most historically predictive short-term drivers are currently in bearish mode. US weather, in particular, is registering no bullish support—a rare and powerful signal. Combined with weak energy signals and an extremely bearish market structure reading, the entire short-term setup is tilted hard against the bulls.

In short, the bear case has gone from strong to near-overwhelming. Unless a surprise weather twist hits or some external demand shock surfaces, the corn market looks destined for more pain.

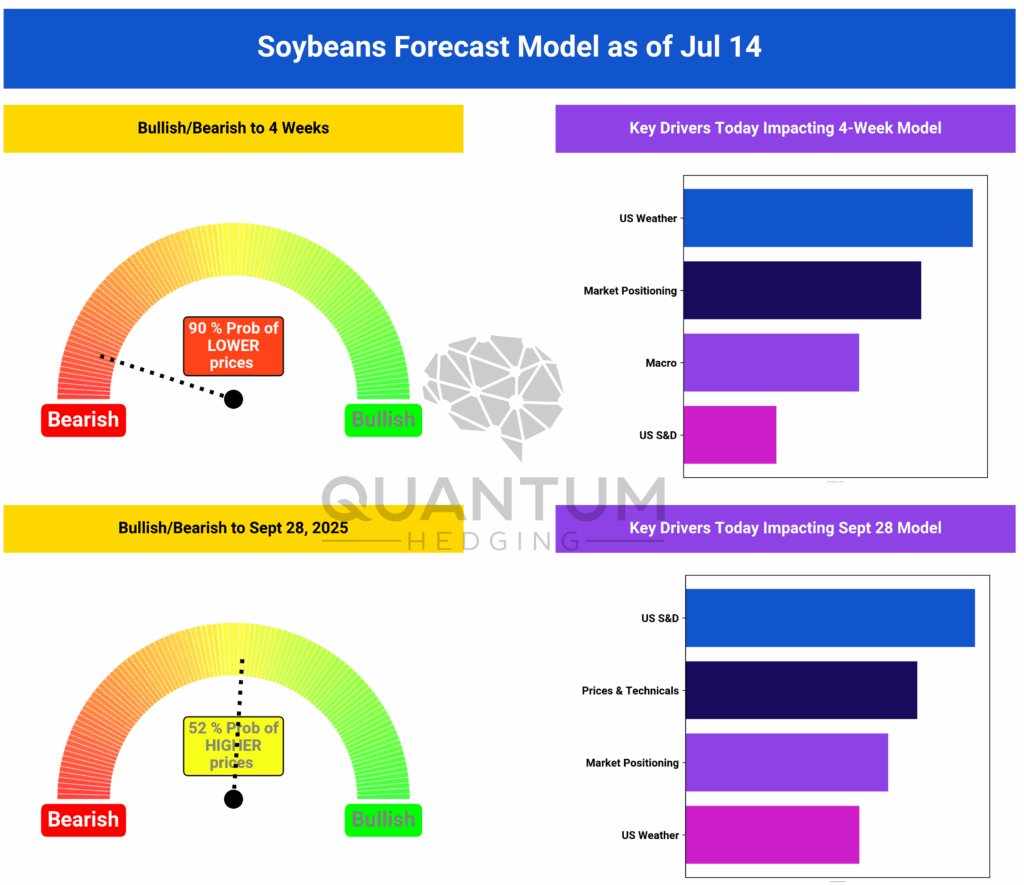

Soybeans: Slammed Short-Term, Hanging On Longer Out

The Quantum Hedging soybean model has followed corn’s lead into bearish territory this week, and it did so with conviction. As of July 14, the model shows a steep 90% probability of lower prices over the next four weeks—its most bearish reading of the season so far.

Driving this sharp downturn is a mix of favorable U.S. weather, which is setting up a strong crop outlook, and bearish market positioning, as traders crowd into the downside. On top of that, macro signals have turned against the oilseed complex, while U.S. supply and demand data isn’t doing enough to push back. The result? A market that’s quickly pricing in supply abundance with no clear driver to flip the script.

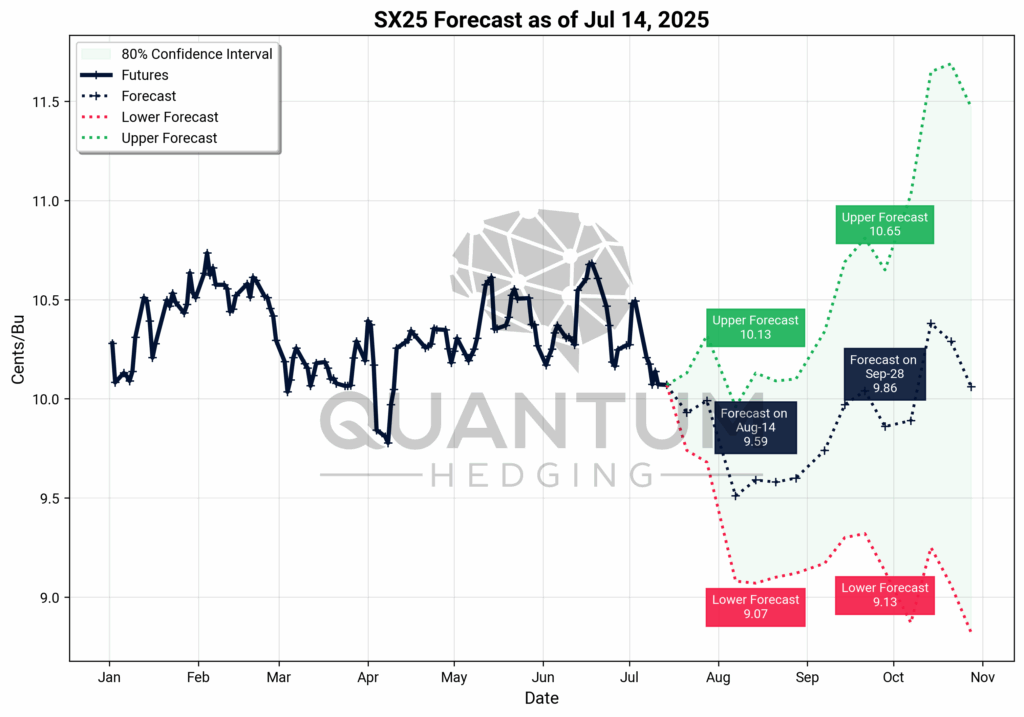

The SX25 forecast mirrors this outlook, projecting a steady move lower through mid-August with a central forecast of $9.59/bu, and a lower bound near $9.07. By late September, there’s some modest recovery potential—with the base case at $9.86 and an upper bound reaching $10.65—but it’s clear the path forward is rocky and uncertain.

That uncertainty is also reflected in the medium-term model outlook, which now shows only a 52% probability of higher prices by September 28. It’s a far cry from last week’s 86% bullish tilt. While U.S. S&D and technical structure are offering some bullish support, the influence of market positioning and continued strong weather patterns is tempering expectations. The model is essentially telling us the upside case is still alive—but it’s losing its edge.

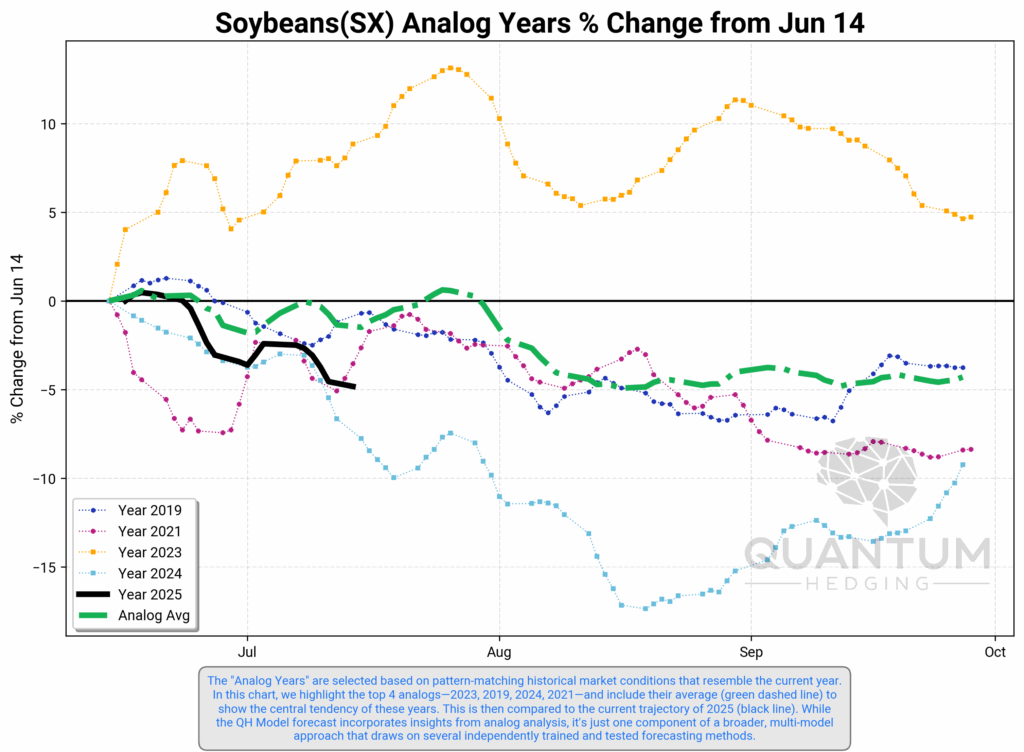

Further complicating the picture, the analog year chart reveals 2025 (black line) has now diverged from the stronger analog years like 2023 and is more aligned with weaker stretches seen in 2021 and 2024. The historical pattern favors sideways-to-lower prices through August, lending weight to the current model stance.

In sum, soybeans have lost the optimism that defined earlier summer forecasts. The short-term pressure is heavy, and while the longer-term outlook hasn’t completely flipped bearish, the conviction behind a fall recovery is clearly weakening. The market is in damage control—and it may take more than a mild weather hiccup to turn this ship around.

Key Feature Drivers in the Next Month (Corn)

This chart highlights the top three features driving corn’s directional bias over the next month, backed by a 30-year track record of predictive success—and the takeaway isn’t pretty for bulls.

The Energy Market comes in with the strongest historical hit rate, correctly flagging short-term corn direction 70% of the time. Currently, it sits in slightly bearish territory, with only 41% of the data pointing bullish. While not extreme, it’s enough to suggest that the energy complex (likely ethanol margins, oil prices, and diesel input costs) is softening the floor for corn.

More concerning is the signal from Market Structure, which also boasts a strong 66% historical accuracy. But today’s signal is flashing a deep bearish red, with just 18% bullish support. That kind of lopsided skew typically points to overextended speculative positioning, soft basis conditions, or poor calendar spreads—conditions that often precede further price erosion.

Another key contributor is the US Weather Metric, which is currently reading as maximally bearish, with 0% bullish support. That doesn’t guarantee a price decline, but it does underscore how strongly the model interprets current growing conditions as a drag on prices. While this feature has a 60% historical success rate—respectable but not definitive—the sheer extremity of the current reading adds meaningful weight to the broader bearish setup.

Taken together, these features paint a stark short-term outlook. All three are historically reliable indicators, and not one is flashing green. With very bearish pressure from both market structure and weather, and only slight resistance from energy, the model is being driven by a consensus: corn’s next move is down—and potentially sharply so.