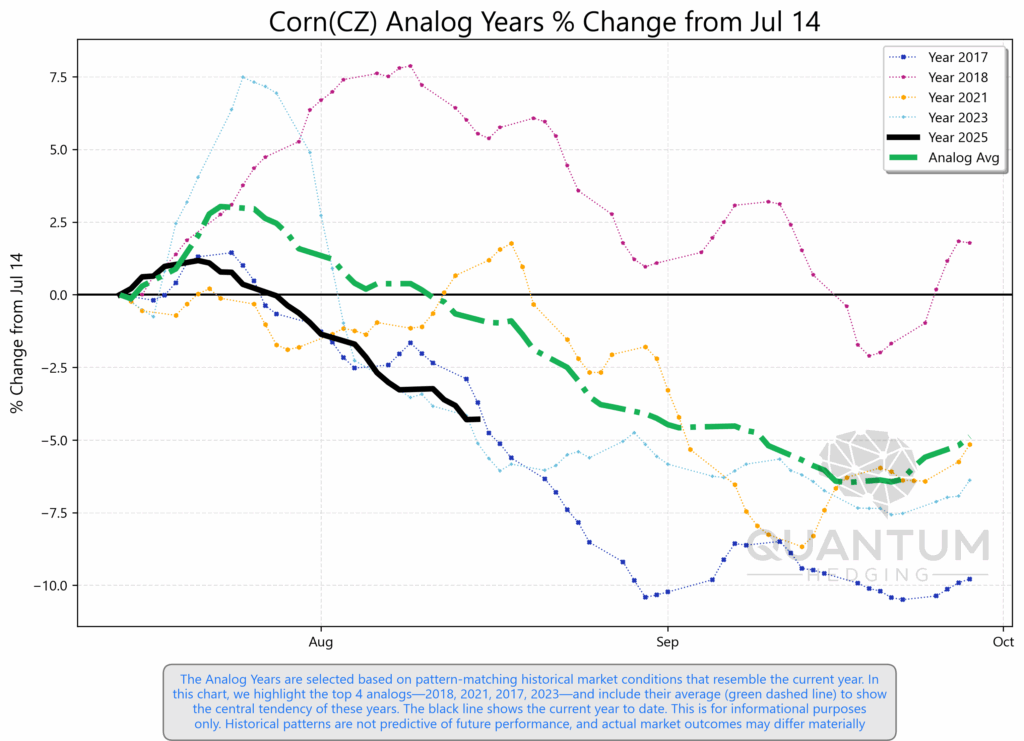

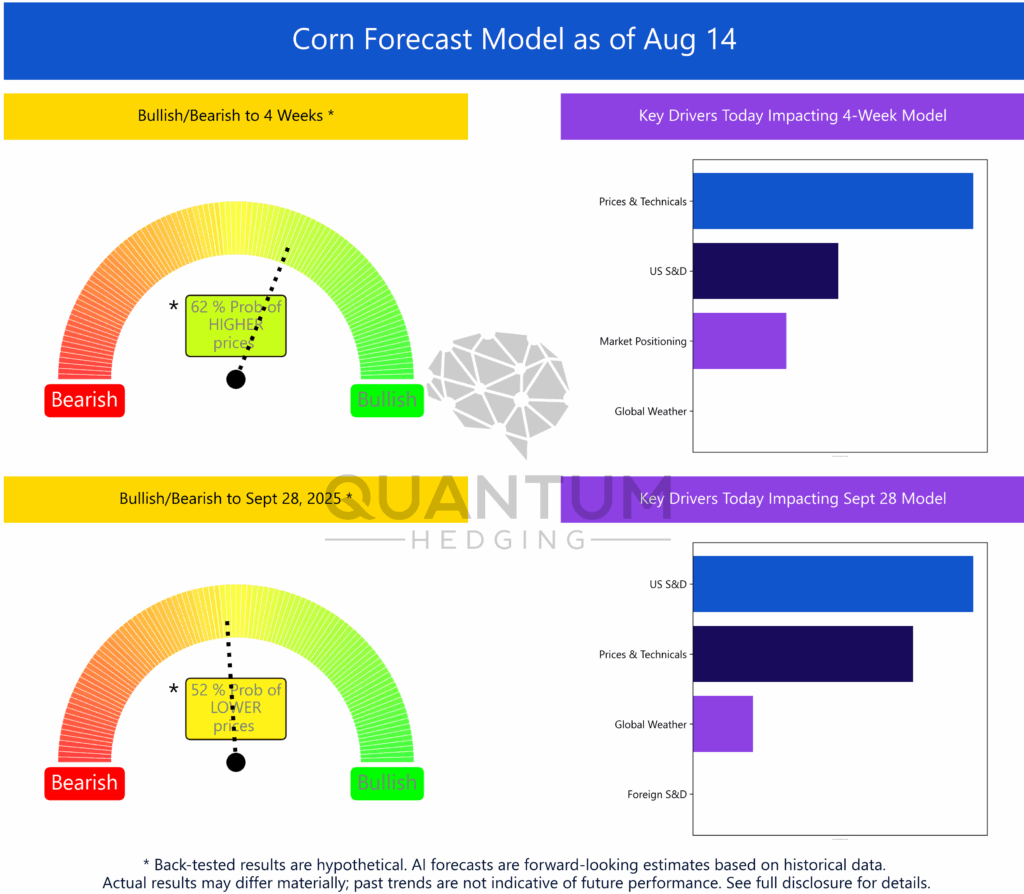

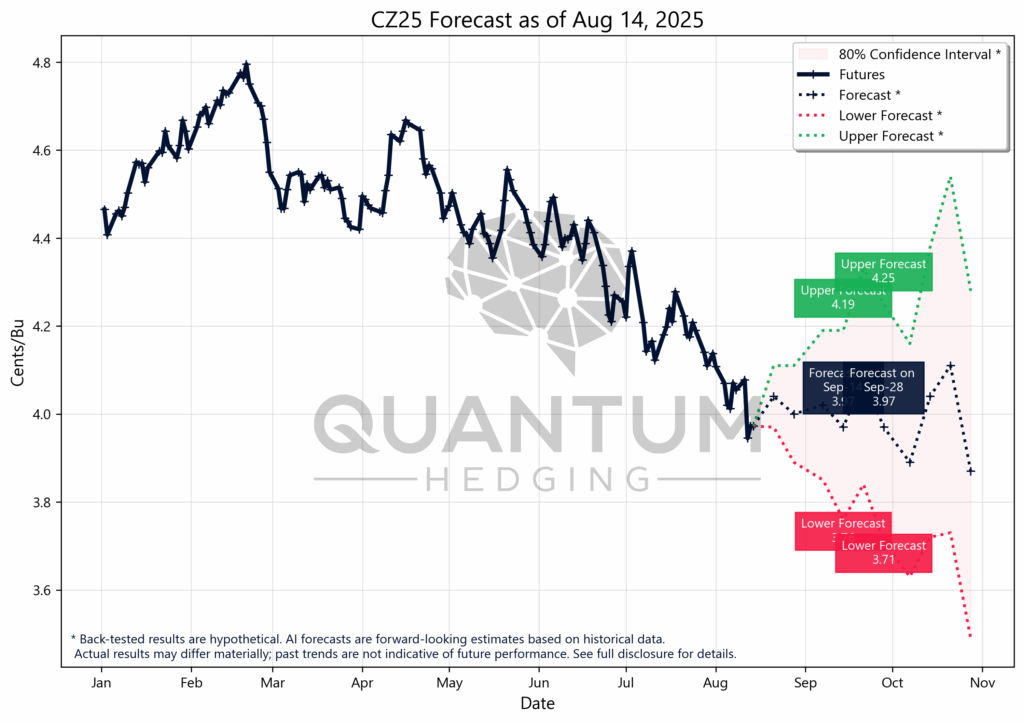

Corn: Cautious Tone as September Approaches

Corn futures are trading higher today, but the Quantum Hedging model continues to signal only a modest edge for further gains over the next month. The 4-week projection shows a 62%* probability of higher prices, supported primarily by prices & technicals and U.S. supply & demand factors. While this tilts the bias upward, it’s far from a high-conviction setup, and the signal strength is muted compared to stronger historical patterns.

Looking further ahead to late September, the balance of risks shifts closer to neutral, with a 52%* probability favoring lower prices. That leaves the medium-term picture more uncertain, suggesting that while short-term momentum could carry prices higher, sustained upside may prove difficult without fresh bullish catalysts.

From a price perspective, the model’s forecast range for the next 6 weeks spans roughly $3.71* to $4.25*, with the median path hovering under $4.00* into late September. This keeps the broader trend leaning soft despite today’s firmness, and market participants may want to remain cautious about chasing rallies until stronger directional signals emerge.

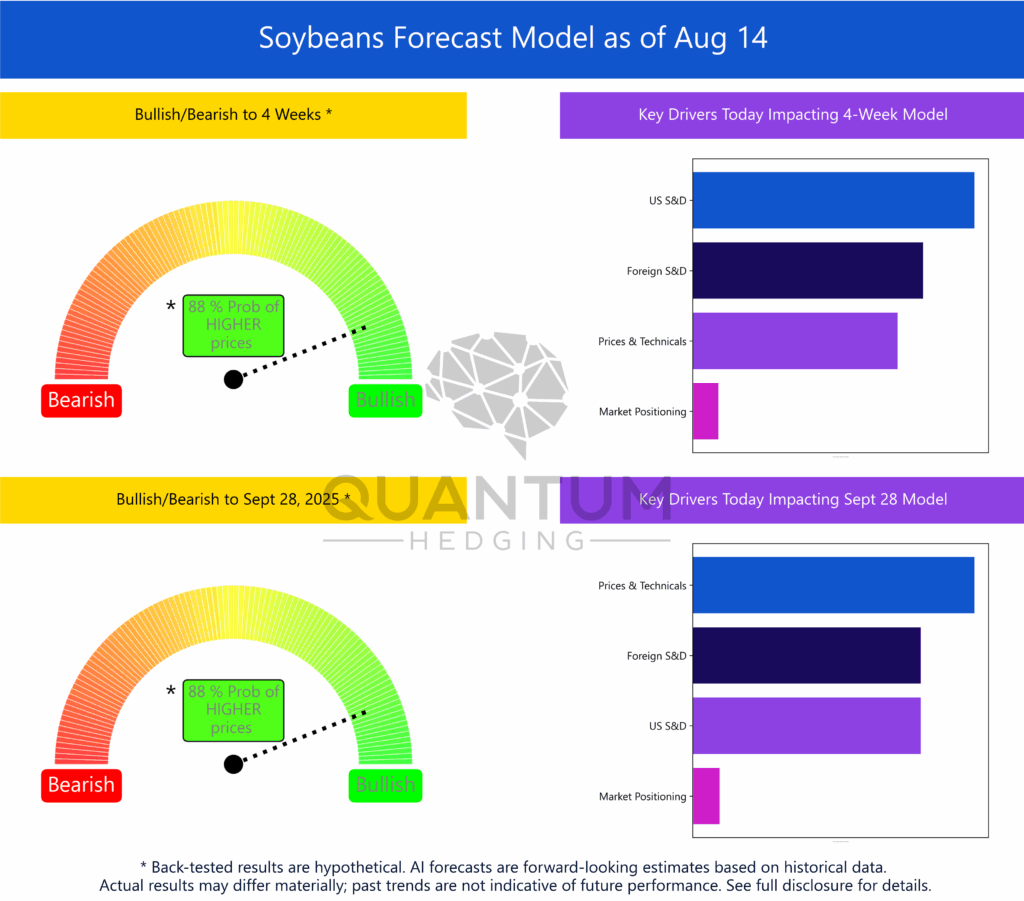

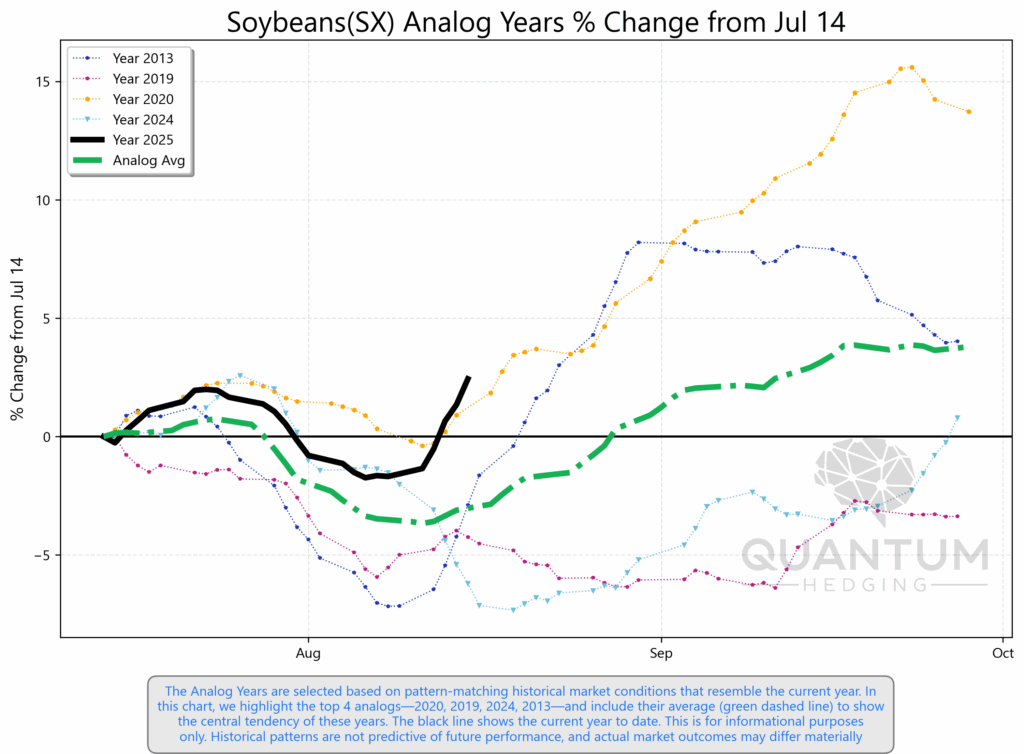

Soybeans: Gradual Upward Bias into Early Fall

The QH model for soybeans is leaning modestly toward higher prices in the near term, with the 4-week forecast showing an 88%* probability of gains. The same 88%* probability extends into late September, suggesting a consistent directional bias across both time frames.

Key drivers for the short-term view include U.S. supply & demand and foreign S&D factors, both currently exerting strong upward influence, while prices & technicals provide additional support. In the longer-term model, prices & technicals take the lead, with foreign S&D and U.S. S&D still prominent contributors.

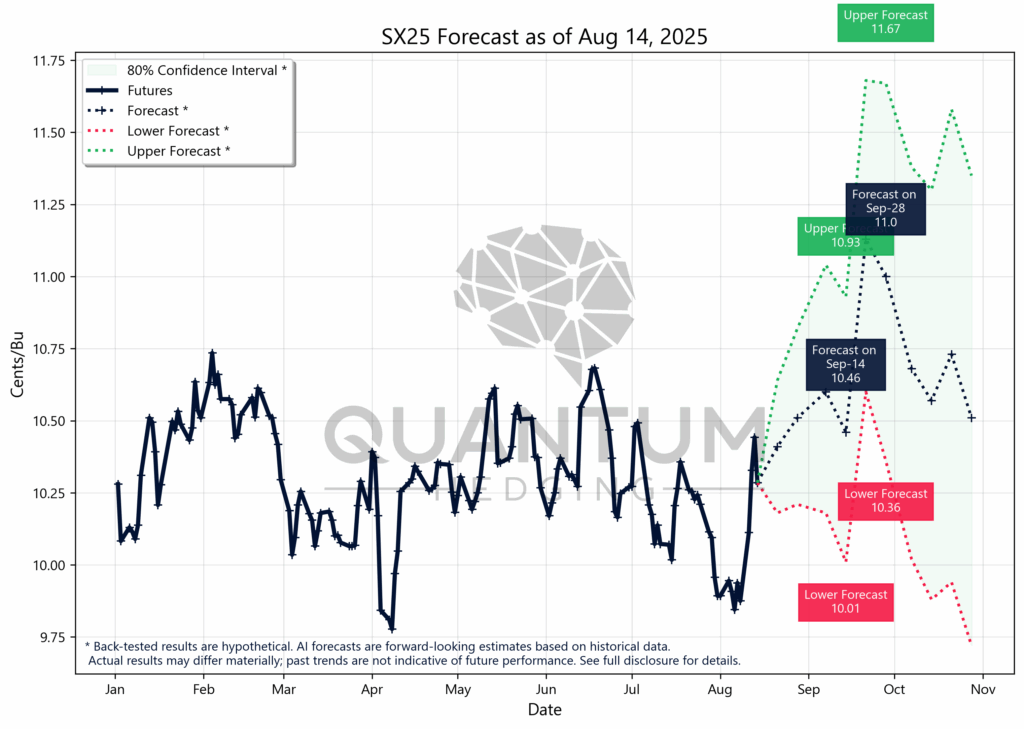

Price projections place SX25 futures around $10.46* by mid-September with potential to test the $11.00*–$11.67* range at the upper bound, while downside scenarios point toward $10.36* to $10.01* over the same period.

While the models show a solid statistical tilt toward strength, recent volatility and mixed technical patterns keep the outlook from being decisively bullish. The bias is constructive, but follow-through will depend on how supply-demand shifts evolve into early harvest.

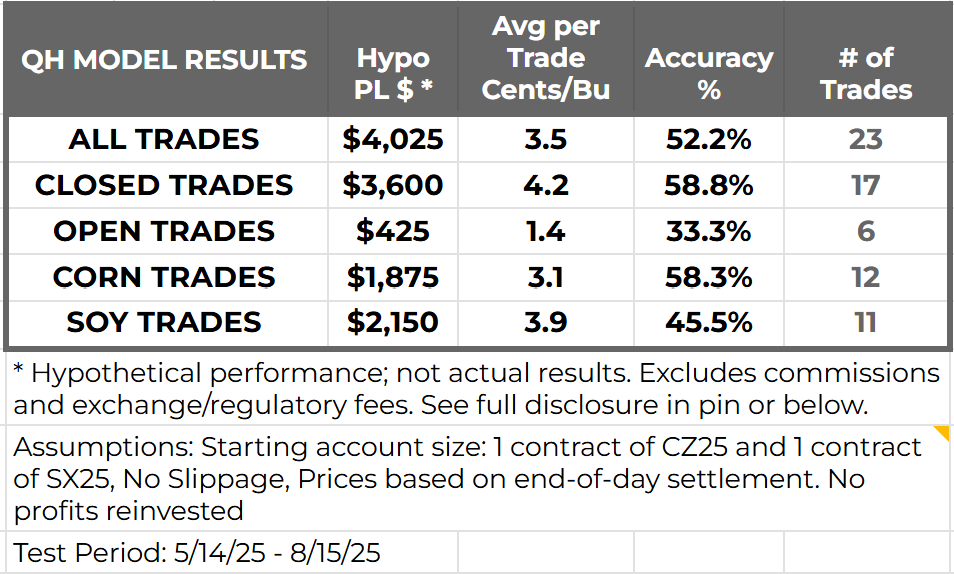

QH Model Forecast Hypothetical Trading Results

Over the past 3 months we have been releasing our QH Model forecasts on corn (CZ25) and soybeans (SX25) on a weekly basis. The tabular data reports the hypothetical trading based on the weekly forecasts which are one month ahead. Each week, a LONG (SHORT) futures position is entered at the next day’s opening price depending on if the month-ahead forecast is HIGHER (LOWER) than the futures price on that forecast date. The position is held and closed out on the settlement price one-month ahead. This trading strategy could have multiple contracts open as positions are taken out each week, but held for one month. These figures are based entirely on back tested assumptions, illustrating how the model’s forecasts might have performed under the stated parameters, without representing actual or live trading.

*Back-tested results are hypothetical. AI forecasts are forward-looking estimates based on historical data. Actual results may differ materially; past trends are not indicative of future performance. See full disclosure for details.