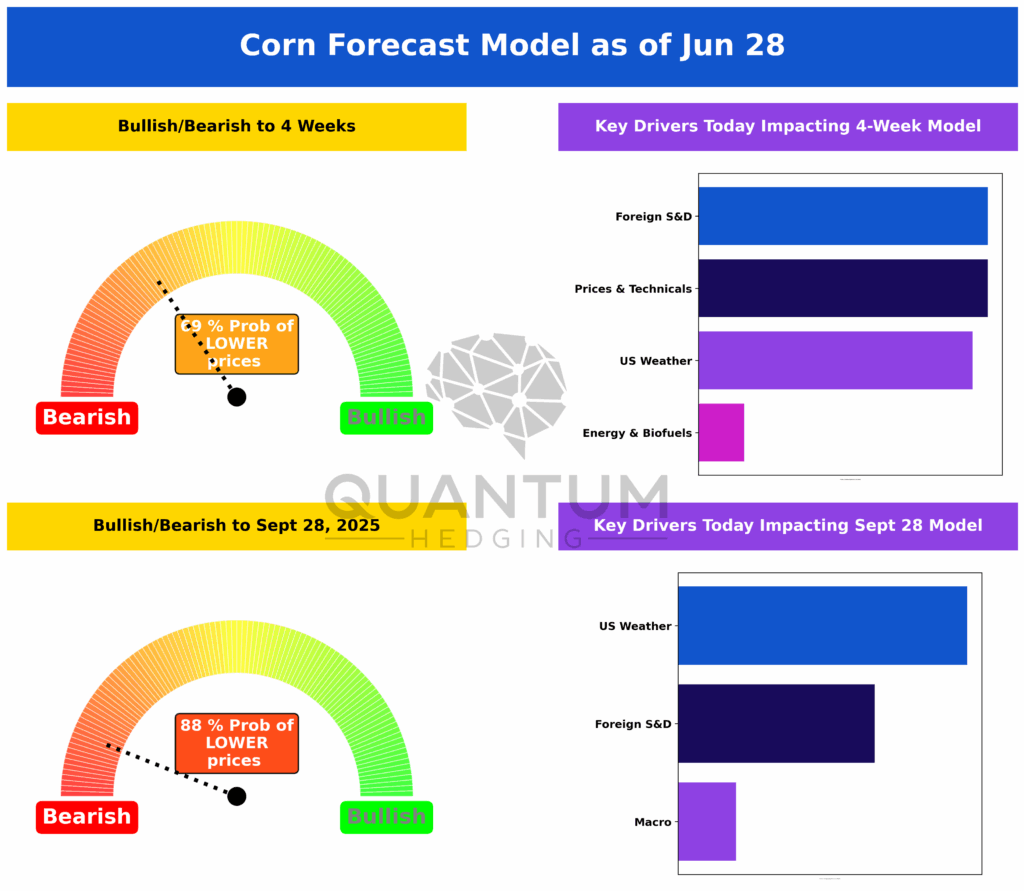

Corn: Weather Woes Weigh Heavier, Bears Still in Control

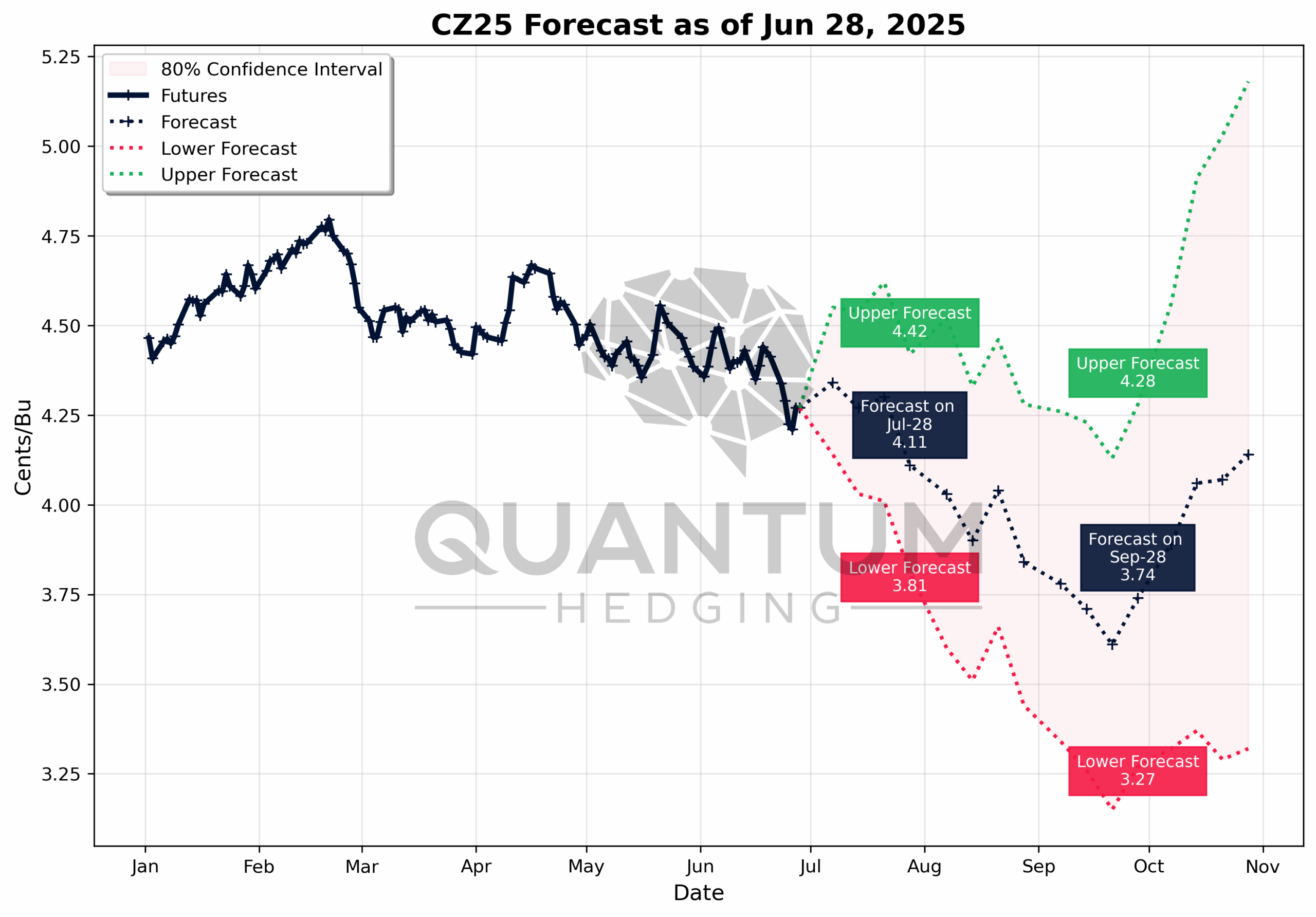

The Quantum Hedging corn model is staying the course—and that course is steeply downhill. As of June 28, the QH corn model sees a 69% chance of lower prices over the next month, driven by near-ideal U.S. weather, soft technicals, and global supply competition.

Zoom out to late September, and the bearish drumbeat only gets louder. The model’s predicting an 88% probability of further downside through harvest, with ideal growing conditions, ample global stocks, and sluggish macro trends all stacking the deck against any kind of bullish rebound.

Bottom line: the corn market’s stuck in the mud, and unless something breaks—like a major weather surprise—don’t be shocked if we slide into the mid-$3s before it’s over.

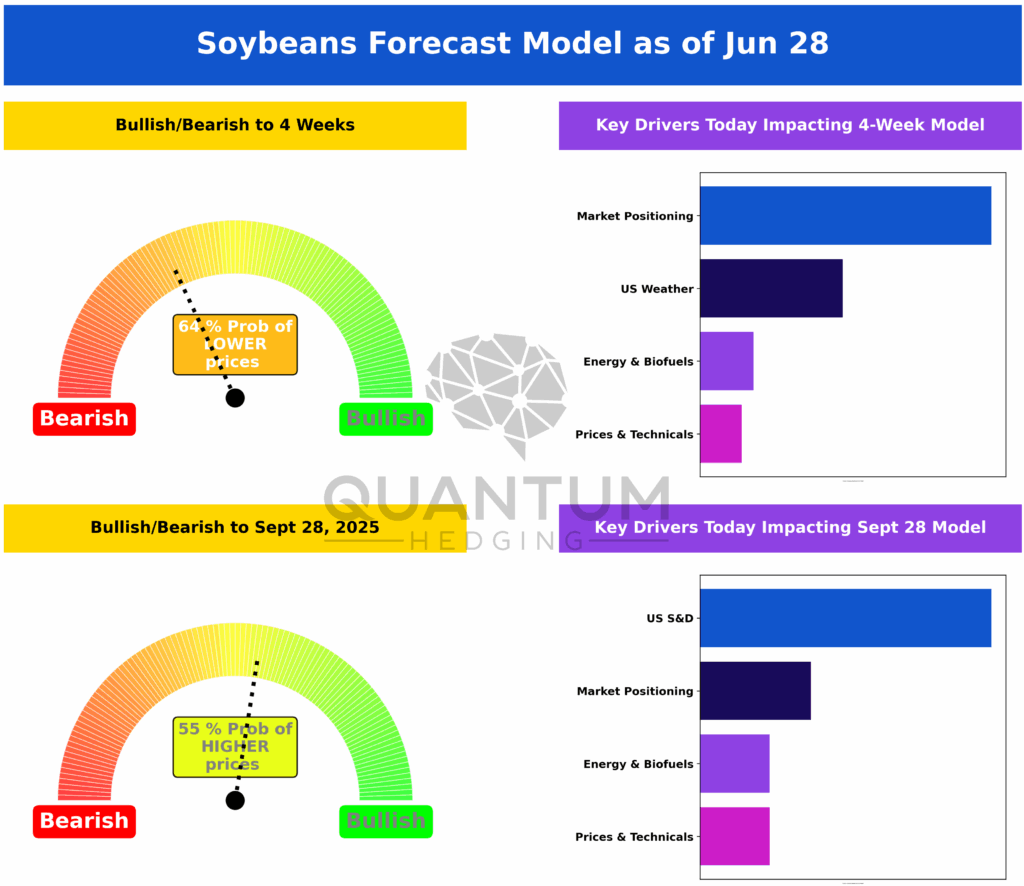

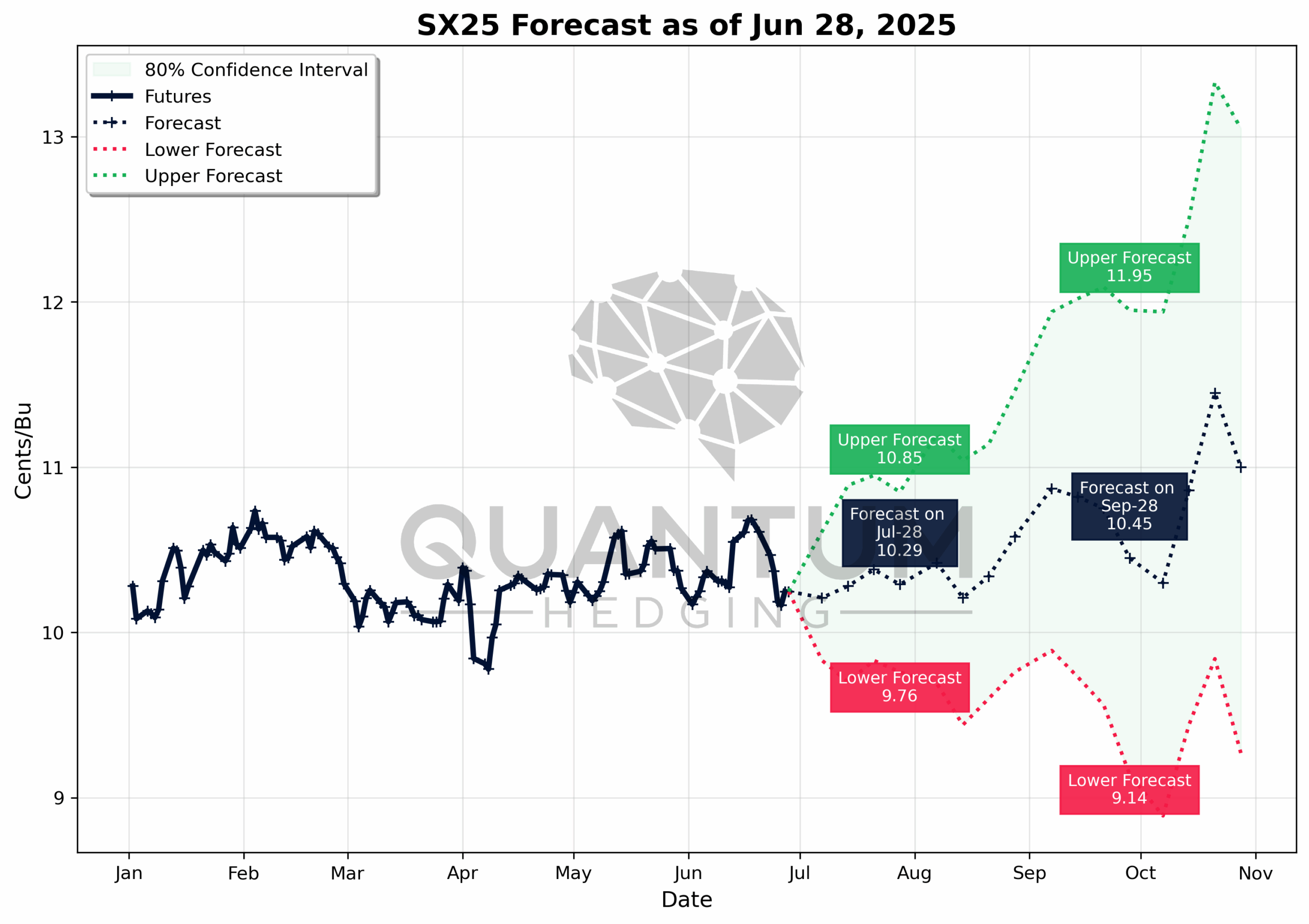

Soybeans: Bearish Tilt Now, But Potential Brewing for Fall

The Quantum Hedging soybean model isn’t as grim as its corn counterpart, but it’s not exactly painting a rosy picture either. As of June 28, the short-term outlook leans bearish, showing a 64% probability of lower prices over the next four weeks. That view is being shaped most heavily by market positioning, where traders seem to be leaning defensively, followed by some pressure from U.S. weather and minor bearish influence from energy.

So while the model isn’t screaming panic, it’s not betting on a rally either. It’s more like a soft push downhill, unless a fresh catalyst steps in.

But zoom out to the medium-term outlook—through September 28, 2025—and the model starts to tilt ever so slightly bullish. It now shows a 55% probability of higher prices into the harvest window. The key difference? Fundamentals. The U.S. supply and demand balance is doing more of the heavy lifting here, supported by moderately bullish signals from market structure and biofuels.

All in all, soybeans are stuck in a middle ground. The near-term is still weighed down by trader behavior and a lack of spark, but further out, tightening supply fundamentals could provide just enough fuel for a modest lift—especially if weather or demand dynamics shift. For now, though, it’s a market caught between two gears.