Corn Bulls are MIA Right Now

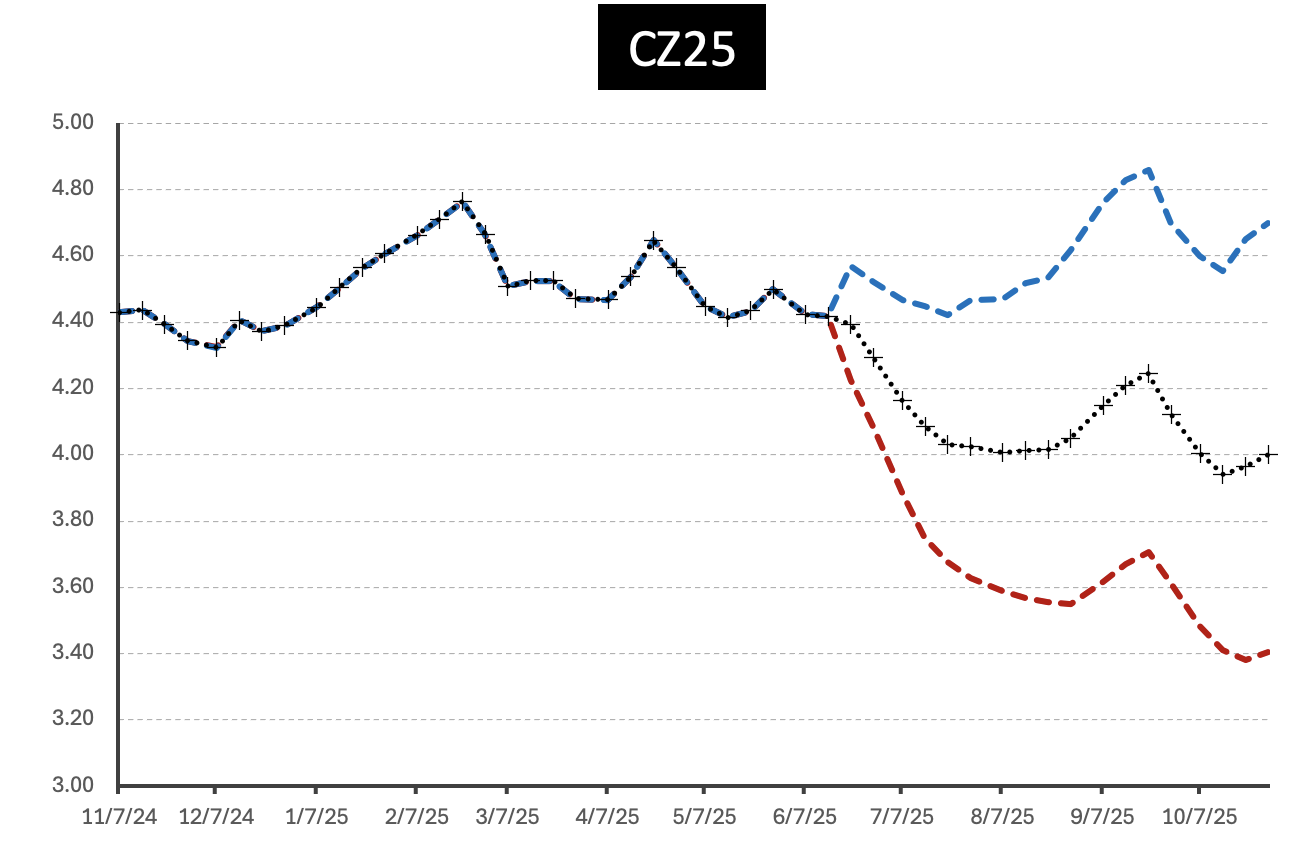

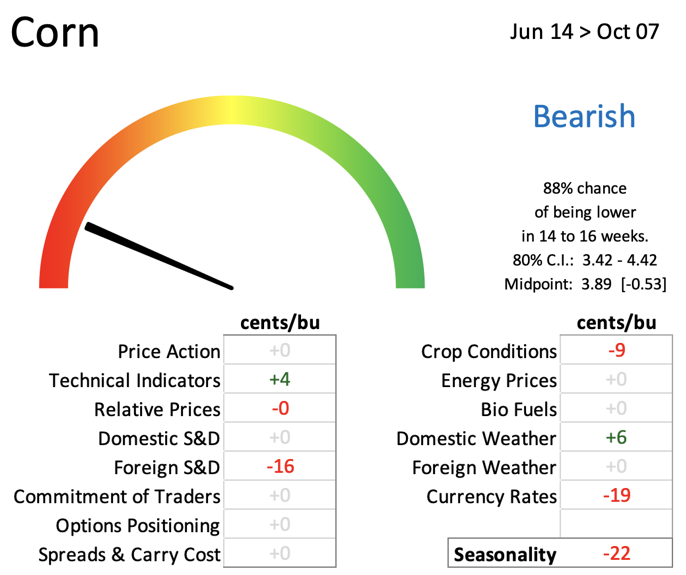

Our corn model flipped bearish two weeks ago—and it’s still waving red flags. Early in the growing season is typically when things start to get interesting, and historically, mid-June is the point where corn prices begin their infamous summer slide. This year? It’s looking like a rerun.

According to the latest QH Model, here’s what’s contributing to the sharp decline in corn prices

- Seasonality’s doing what it does best—being a buzzkill.

- A weakening Brazilian Real is anti-bullish as it opens up more competitive pressure from their safrinha corn crop export program.

- Global supply & demand is starting to swing the pendulum to more bearish and with a good US growing season so far, it creates a drag to higher prices.

Right now, the data is signaling caution. Stay sharp out there!

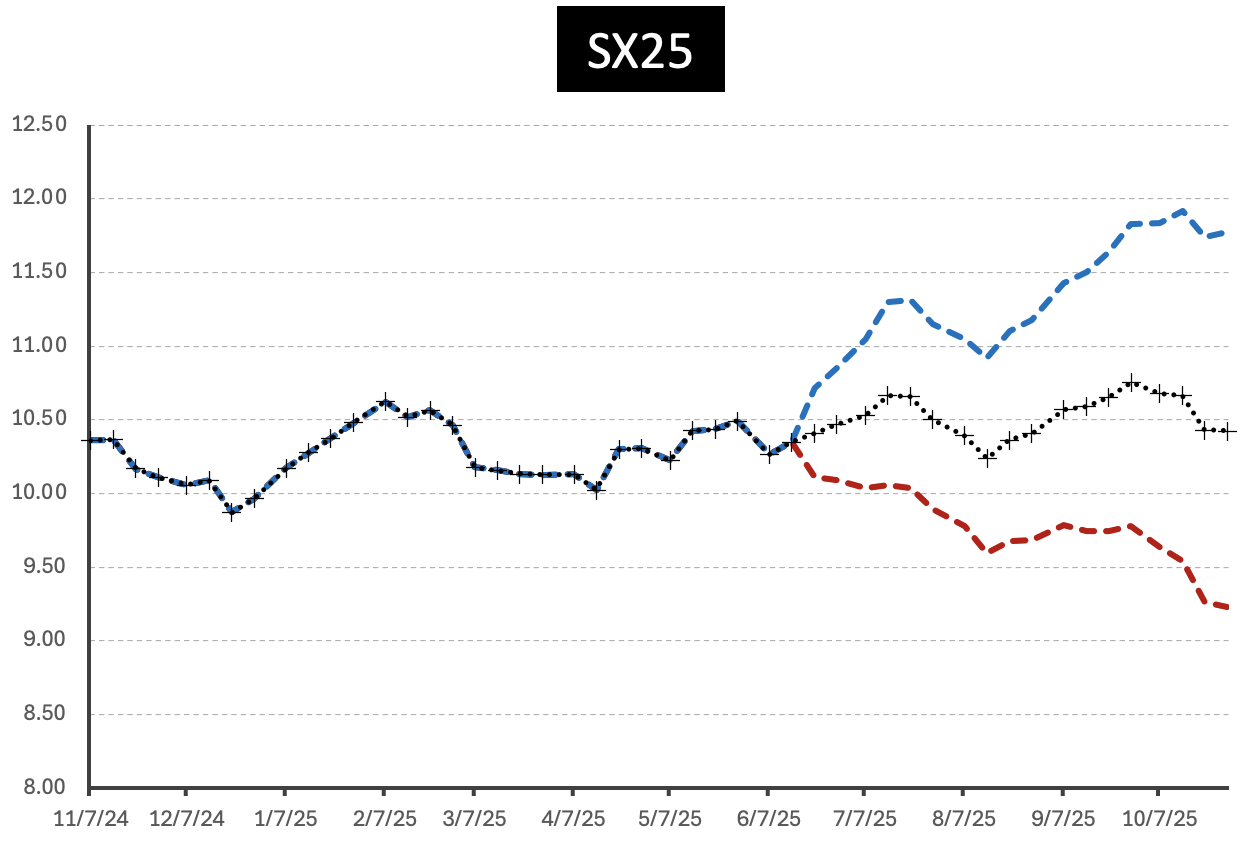

Soybeans are in Switzerland Territory

Neutral, stagnant, and kind of just… there.

Soybeans aren’t in as much trouble as corn, but they’re not exactly going anywhere fast. The QH Model sees mostly sideways action through September, with prices waiting for something to shake things up.

Here’s what’s behind the model’s neutral stance:

-

Seasonality is doing what it usually does in summer: soft and uneventful.

-

U.S. supply & demand? Yeah, not helping.

-

Tech Signals are trying to nudge prices higher, but with limited strength.

-

Trader positioning shows some cautious bullish interest, but not enough to break out.

For now, soybeans remain stuck between mild optimism and a lack of real momentum. Without a stronger catalyst, prices are likely to drift sideways.