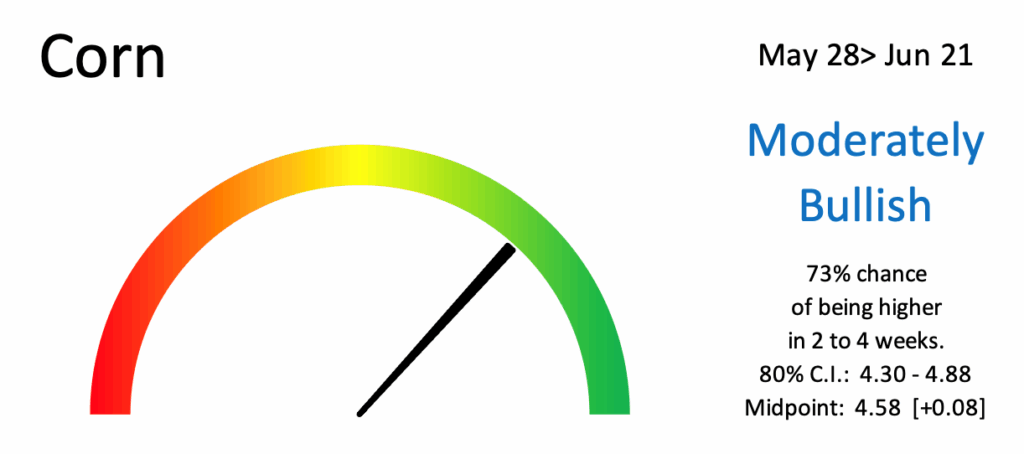

Here’s our model’s latest corn price forecast as of May 28th.

The model is moderately bullish on corn over the next 2 to 4 weeks, taking us out to mid to late June.

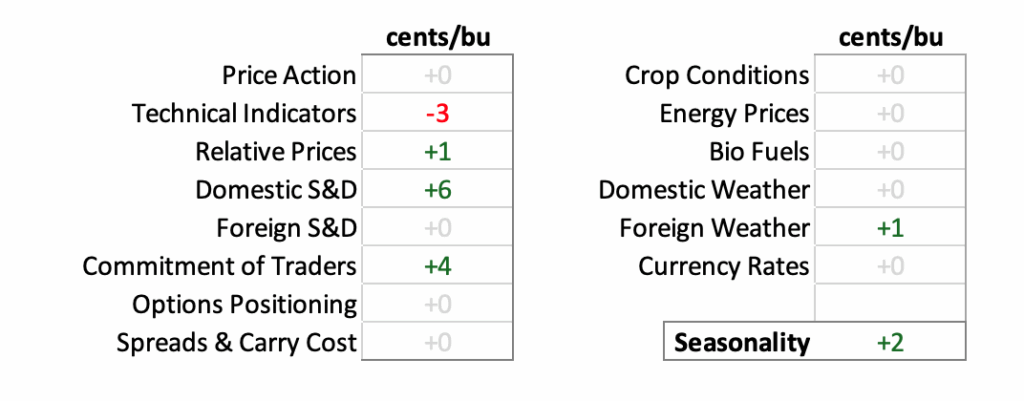

Seasonality remains slightly bullish during this window—and historically, the bigger price moves this time of year tend to be to the upside. That said, mid-June is often an inflection point, where corn prices typically peak and then decline about 70% of the time between June and October.

As of now, the model shows a 73% probability that the CZ25 corn contract will be higher by June 21st.

It also provides an expected price range of $4.30 to $4.88, with 80% probability, and a midpoint of $4.58.

Key bullish drivers in the model this week include:

- U.S. supply-side numbers

- Commitment of Traders positioning

The main drag on the forecast? Technical indicators, which continue to flash slightly bearish signals and are holding back a more aggressive upward projection.

Bottom line:

Even amid ongoing international trade policy uncertainty—which warrants some discounting of directional confidence—our model maintains a moderately upward short-term view.

We’ll keep tracking the data closely and will update the outlook each week as we approach the seasonal pivot point.

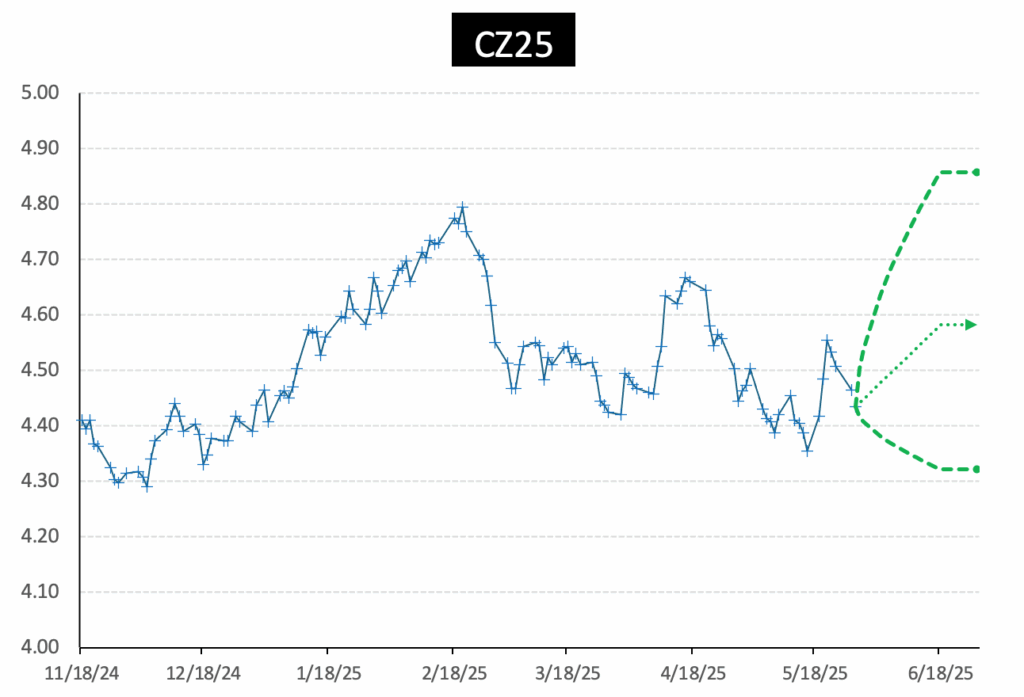

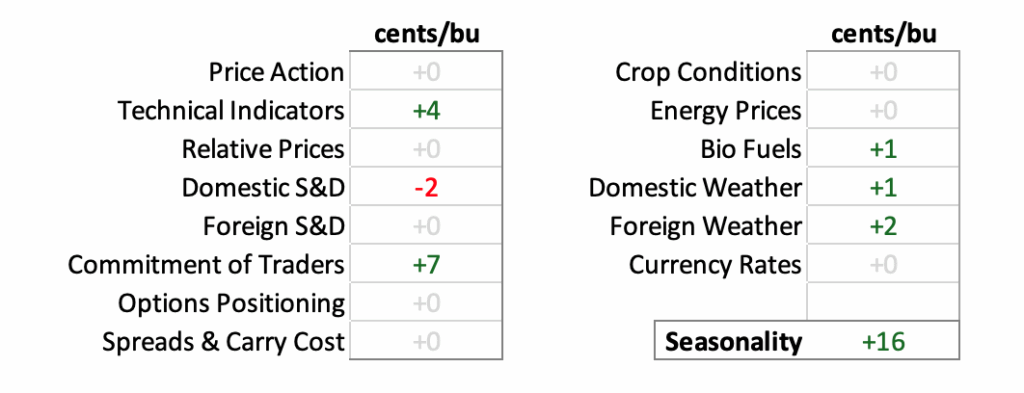

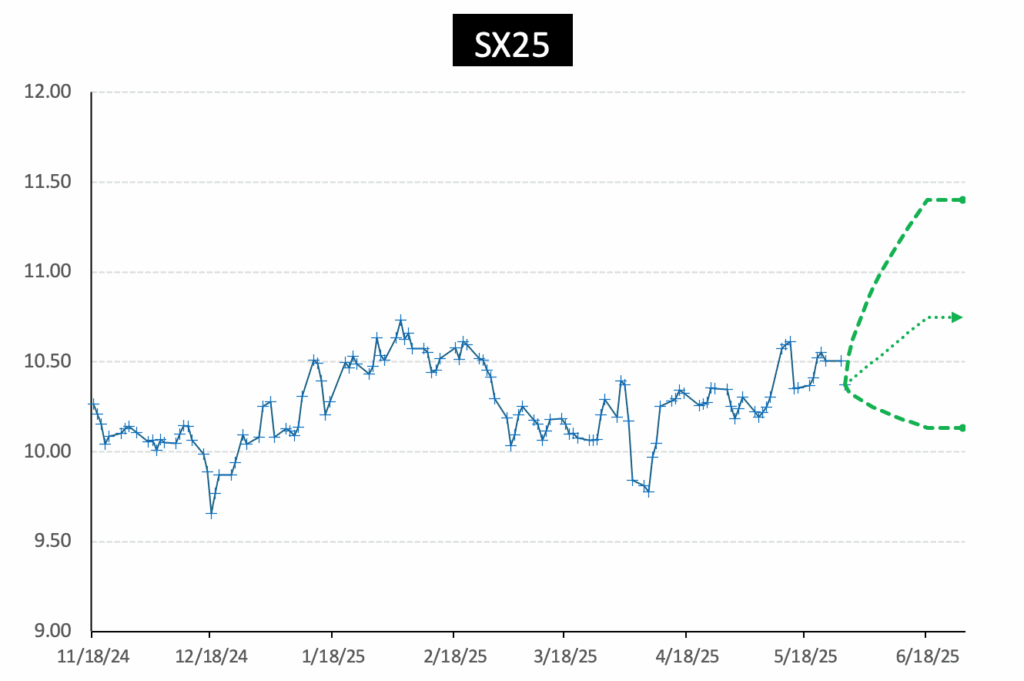

Here’s our model’s latest soybean price forecast as of May 28th.

The model is moderately bullish on soybeans over the next 2 to 4 weeks, taking us out to mid to late June.

Seasonality is bullish during this window—and historically, the bigger price moves this time of year tend to be to the upside. That said, mid-June often acts as an inflection point, where prices peak and then decline roughly 70% of the time between June and October.

At the moment, the model shows a 76% probability that the SX25 soybean contract will be higher by June 21st.

It also projects an expected price range of $10.13 to $11.40, with 80% probability, and a midpoint of $10.75.

Key bullish drivers in the model this week include:

- Technical indicators, which are leaning positive

- Commitment of Traders positioning

- Weather patterns in South America, which remain supportive

As a counterbalance, some U.S. supply and demand indicators are slightly bearish, holding back a more aggressive forecast.

Bottom line:

Even with ongoing international trade policy uncertainty, which justifies discounting the directional confidence somewhat, our model still maintains a moderately upward short-term view.

We’ll continue tracking the data and updating the forecast weekly as we approach the seasonal pivot.

Start Hedging Your Grain with AI

Love the forecasts but need help hedging? Let our proprietary AI-managed bushel program carry the heavy lifting of managing your hedging needs. Enroll in our Max10 program today.