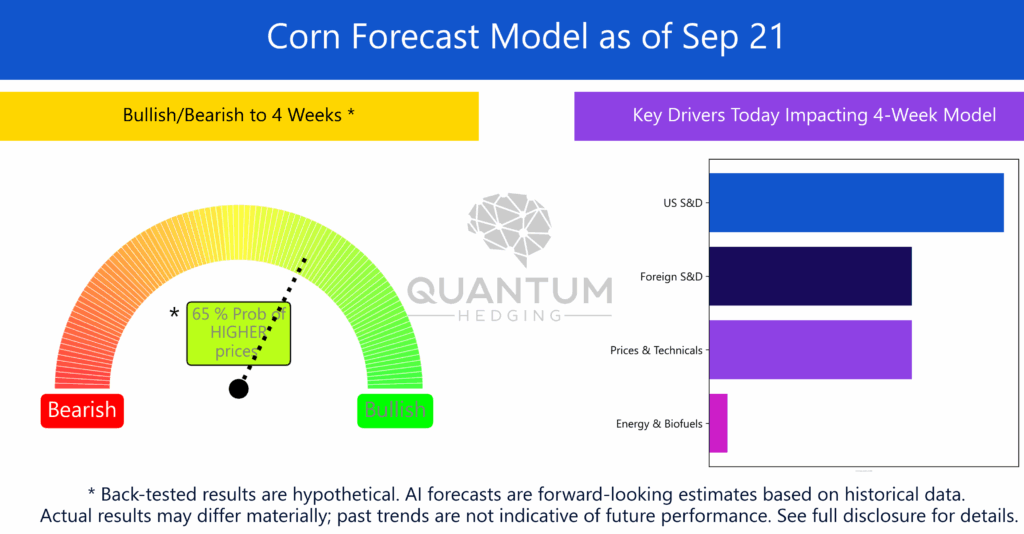

Corn: Leaning Upward, Lacking Momentum

The Quantum Hedging corn model shows a 65%* probability of higher prices over the next four weeks. Support is coming primarily from U.S. supply & demand, with foreign S&D and technical factors adding reinforcement. Energy & biofuels remain a minor influence.

The near-term tilt is constructive, but conviction is not overwhelming. The market appears to be stabilizing after recent weakness, with futures projecting toward mid-$4.00s into late October.

From a fundamental perspective, yield estimates are unlikely to rise further, and dryness in parts of the Corn Belt lingers as a background factor. Still, with harvest underway, weather’s impact is less decisive than earlier in the season.

Taken together, the outlook is neutral to modestly supportive — enough to lean higher near term, but not yet a strong signal of sustained strength.

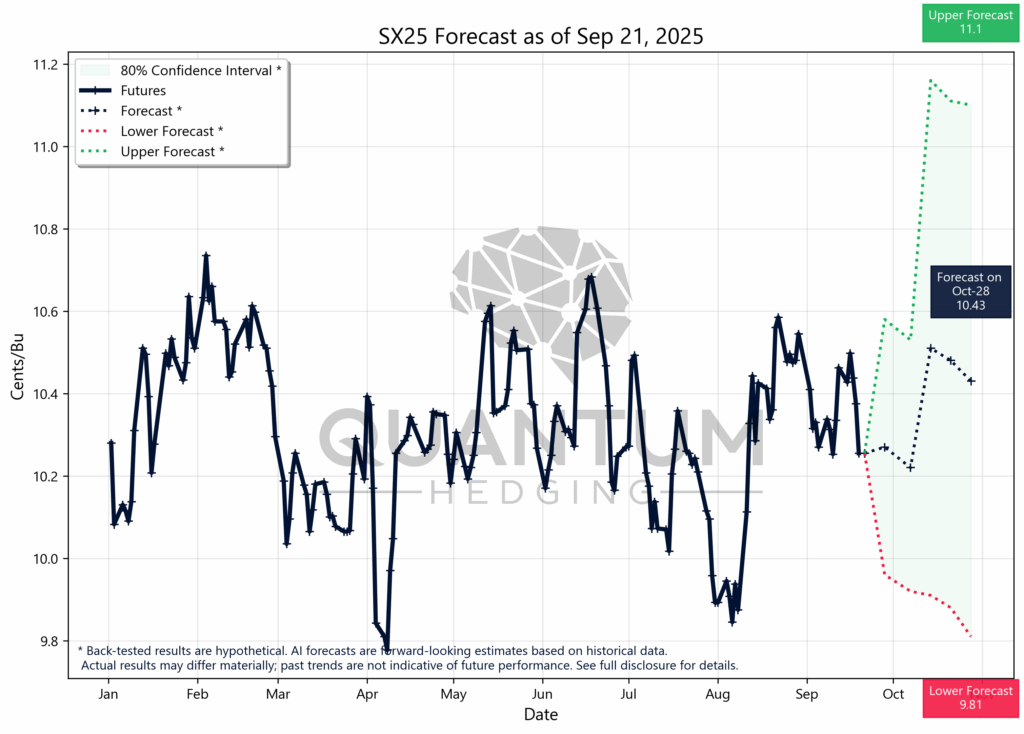

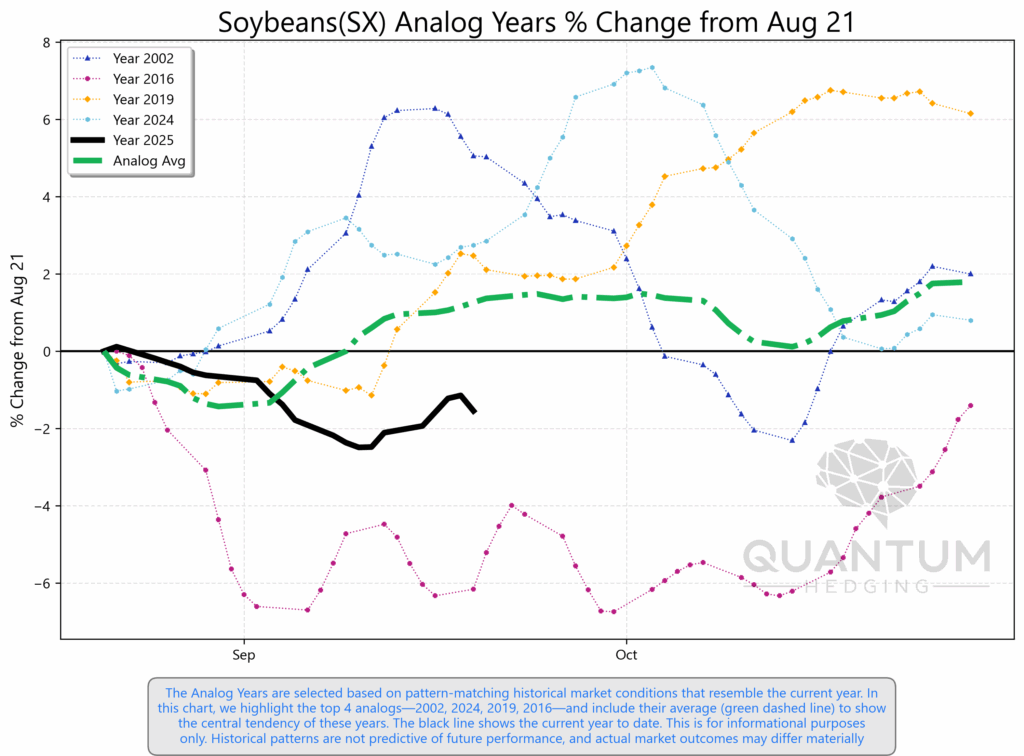

Soybeans: Short-Term Lift, Demand Still Decides

The Quantum Hedging soybean model is signaling a 74%* probability of higher prices in the next four weeks, with prices & technicals as the leading driver. Energy & biofuels, foreign demand, and positioning add secondary support.

Futures projections point toward the mid-$10s by late October, with room to test higher if the upper range develops. The model’s confidence has firmed compared to recent weeks, giving the short-term tone a more constructive feel.

That said, follow-through will hinge on export flows and global demand. Without stronger pull from buyers, the upward bias may meet resistance. For now, though, the market’s tilt remains clearly pointed higher.

*Hypothetical performance; not actual results. Excludes commissions and exchange/regulatory fees.

*Back-tested results are hypothetical. AI forecasts are forward-looking estimates based on historical data. Actual results may differ materially; past trends are not indicative of future performance. See full disclosure for details.